~37% of filers qualify. Form 1040 + limited credits only.

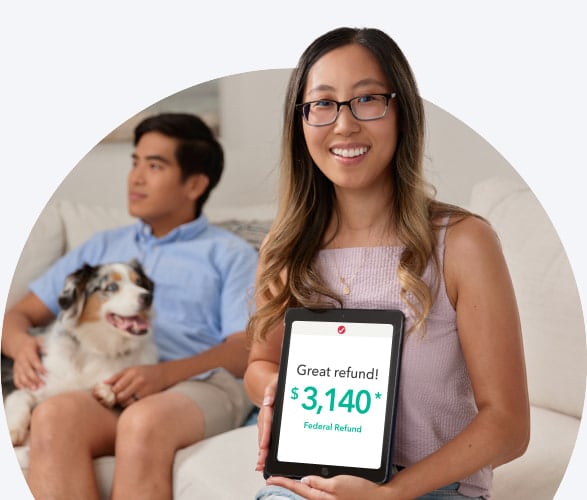

Transfer last year’s info for a head start on your taxes with TurboTax Free Edition.

Transfer last year’s info for a head start on your taxes with TurboTax Free Edition.

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits

A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). Roughly 37% of taxpayers are eligible.

If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition or TurboTax Live Assisted Basic (if available), or you can file with TurboTax Full Service at the listed price.

Situations covered (assuming no added tax complexity):

Situations not covered:

TURBOTAX ONLINE GUARANTEES

TurboTax Individual Returns:

TurboTax Business Returns:

TURBOTAX ONLINE/MOBILE PRICING:

TURBOTAX DESKTOP GUARANTEES

TurboTax Desktop Individual Returns:

TurboTax Desktop Business Returns:

TURBOTAX DESKTOP

All features, services, support, prices, offers, terms and conditions are subject to change without notice.

QuickBooks

#1 Accounting Software for Small to Midsize Business based on PCMag, as of November 2019.

System Requirements: Please see for specific requirements: QuickBooks Online works with the following Windows 7 and 8, Mac OS X 10.8 (Mountain Lion), 10.9 (Mavericks), 10.10 (Yosemite), or

Chromebooks, Internet connection required (high-speed connection recommended), accessible via mobile browsers: Android, Chrome (Android and iOS) and Safari.

*Based on a survey of small businesses using QuickBooks Online, conducted September 2018 who stated average savings compared with their prior solution.

For hours of support and how to contact support, click here.

QuickBooks supported browsers: Chrome, Firefox, Edge, Internet Explorer 10, Safari 6.1.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

© 2025 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

Photographs © 2018 Jeremy Bittermann Photography. By accessing and using this page you agree to the terms and conditions.