As the Class of 2025 prepares to walk across the stage and as twenty-somethings across the U.S. transition into early adulthood, they’re stepping into an unpredictable world. From inflation to the job market, life-ing has proven to be hard, but here’s what might surprise you: they’re not panicking. They’re planning.

Today’s young adults are financially cautious, emotionally resilient, and clear-eyed about the road ahead. For them, stability isn’t inherited — it’s built. So at Intuit, we set out to better understand this pivotal moment in customers’ financial lives and asked over a thousand 18-25-year-olds (think: recent grads, soon-to-be grads, and those already financially independent) how they’re navigating it all — from their wallets to their version of “making it” today.

Because whether you’re saving for the future or starting a side hustle, Intuit’s platform is here to make life-ing easier. Whether it’s filing taxes with Intuit TurboTax, building credit with Intuit Credit Karma, getting a small business off the ground with Intuit QuickBooks, or growing an audience with Intuit Mailchimp, we’re here to help.

Modern Money: Realistic Optimism in an Unpredictable Environment

Let’s be real — young adults today aren’t walking into adulthood with rose-colored glasses. They know what they’re up against. Much like the graduates of 2008, who stepped into a recession-riddled job market, this generation is entering the market with eyes wide open. The difference? They’re armed with technology, AI, and a digital-first world on their side.

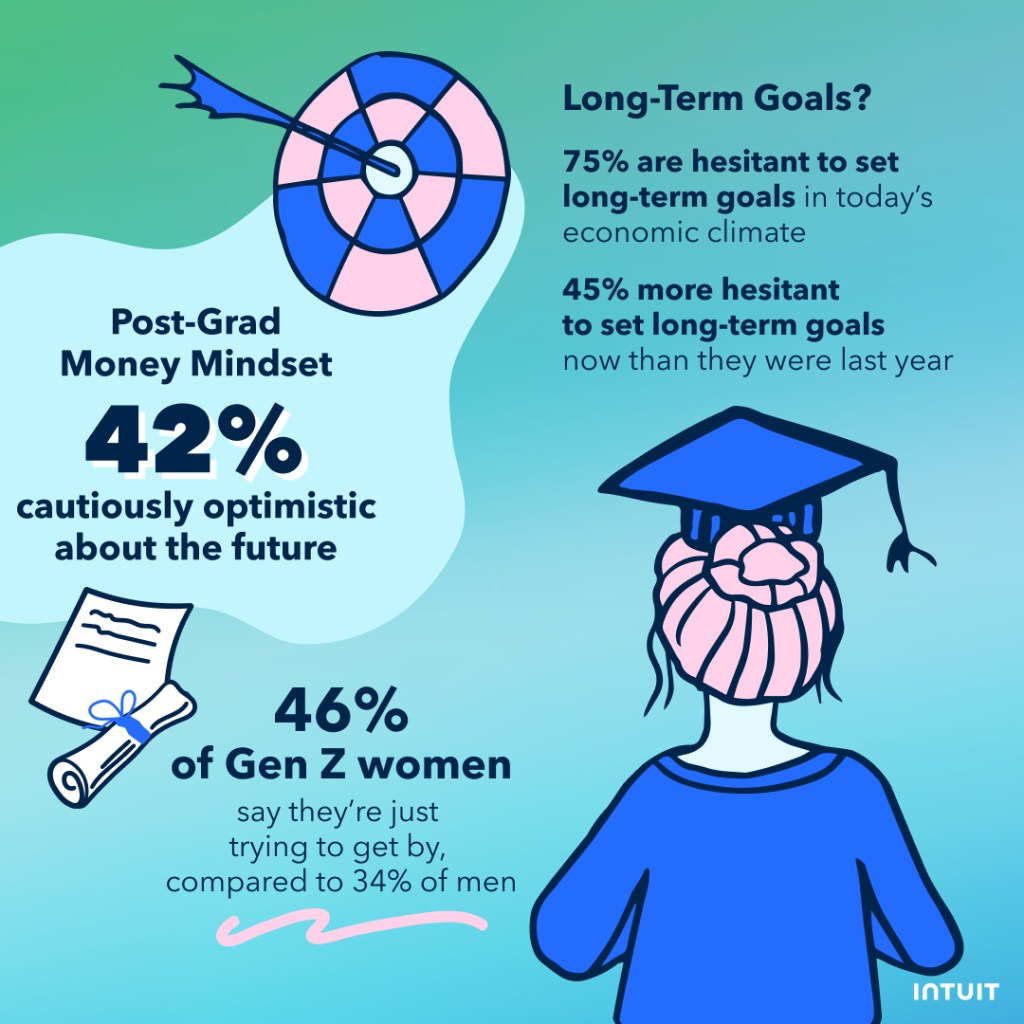

Our latest findings paint a nuanced portrait of today’s young adults — one that blends aspiration with realism:

• 42% say they’re cautiously optimistic about the future

• 75% are hesitant to set long-term goals in today’s economic climate

• 45% are more financially hesitant now than they were last year

• 46% of Gen Z women say they’re just trying to get by, compared to 34% of men

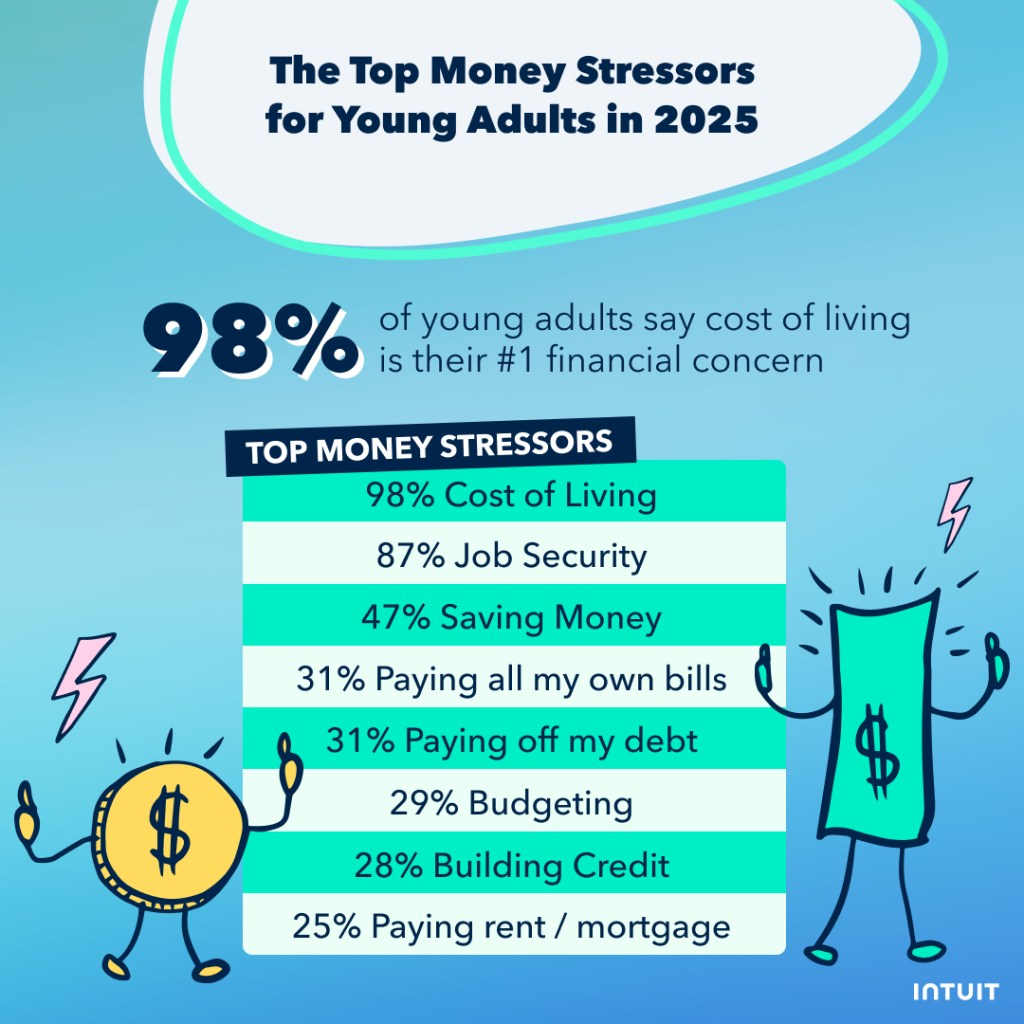

Top Money Stressors in 2025

Despite their cautious optimism, young adults are feeling financial stress from all sides. The essentials like rent or mortgages, groceries, bills, and student loans are hitting hard. 98% of young adults say the cost of living is their #1 financial concern with job security coming next (87% listing job security as a top concern).

• Cost of Living (98%)

• Job Security (87%)

• Saving Money (47%)

• Paying all my own bills (31%)

• Paying off Debt (31%)

• Budgeting (29%)

• Building Credit (28%)

• Paying rent/mortgage (25%)

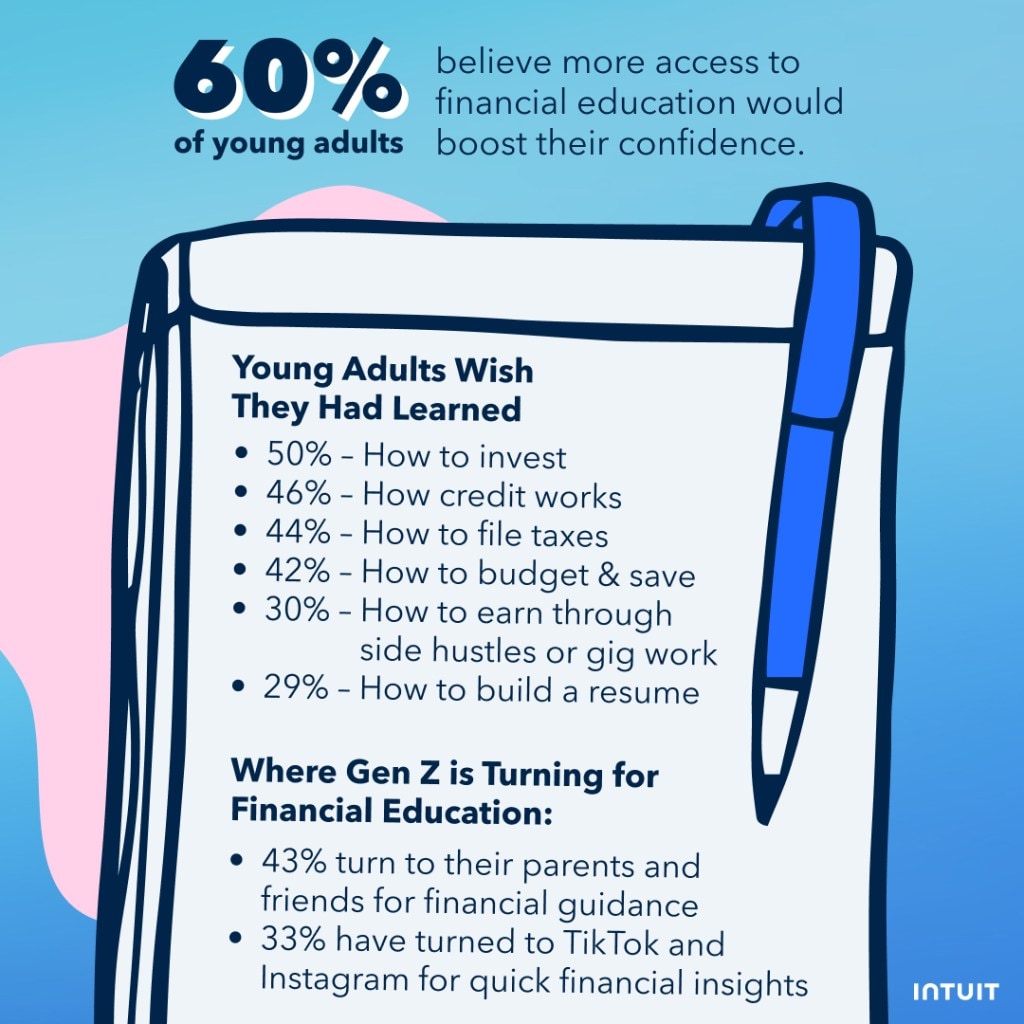

The Financial Education Gap

One theme echoed across the study: traditional education didn’t prepare this generation for the real-world money challenges they’re facing today. Managing money, understanding credit, or even filing taxes simply weren’t part of the curriculum. In fact, an Intuit study from 2024 revealed that 85% of U.S. high school students say they’re interested in learning about financial topics in school, and 95% of students who currently receive financial curriculum find it helpful.

I personally didn’t learn foundational financial concepts until college — and even then, it wasn’t in a classroom. In many cultures like my own, money was something you earned and spent, not a tool for building long-term prosperity. No one talked about investing or long-term planning. That didn’t change for me until I finally got access to the right tools and real-world knowledge. And honestly? It changed the game. It improved my financial trajectory — and it can do the same for others.

According to Intuit’s findings, young adults wish they had learned:

• 50% – How to invest

• 46% – How credit works

• 44% – How to file taxes

• 42% – How to budget and save

• 30% – How to earn money through side hustles or gig work

• 29% – How to build a resume

60% of our survey respondents believe more access to financial education would boost their confidence. And in the absence of formal education? They’re turning to family, friends, and social media to fill the gaps.

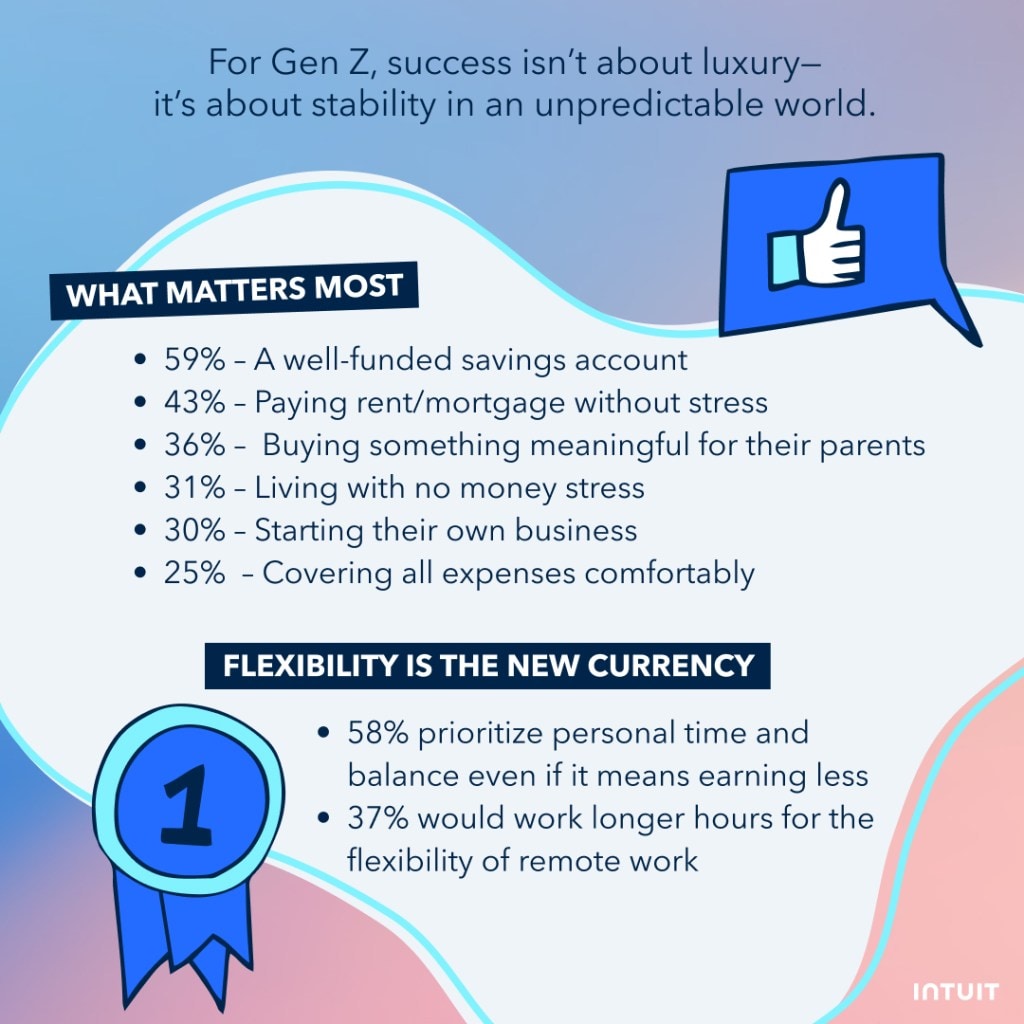

Redefining Success: What Stability Looks Like Now

For today’s young adults, financial success isn’t defined by flashy wealth, it’s about peace of mind. They want security, stability, and the ability to support themselves and their loved ones. They’re thinking about earning enough to live a prosperous and comfortable life, not overindulging on fleeting items that don’t add life-long value. They also value flexibility with 37% saying they’d work longer hours for the ease and flexibility of remote work.

Here’s what they prioritize:

• 59% – A well-funded savings account

• 43% – Paying rent/mortgage without stress

• 36% – Buying something meaningful for their parents

• 31% – Living with no money stress

• 30% – Starting their own business

• 25% – Covering all expenses comfortably

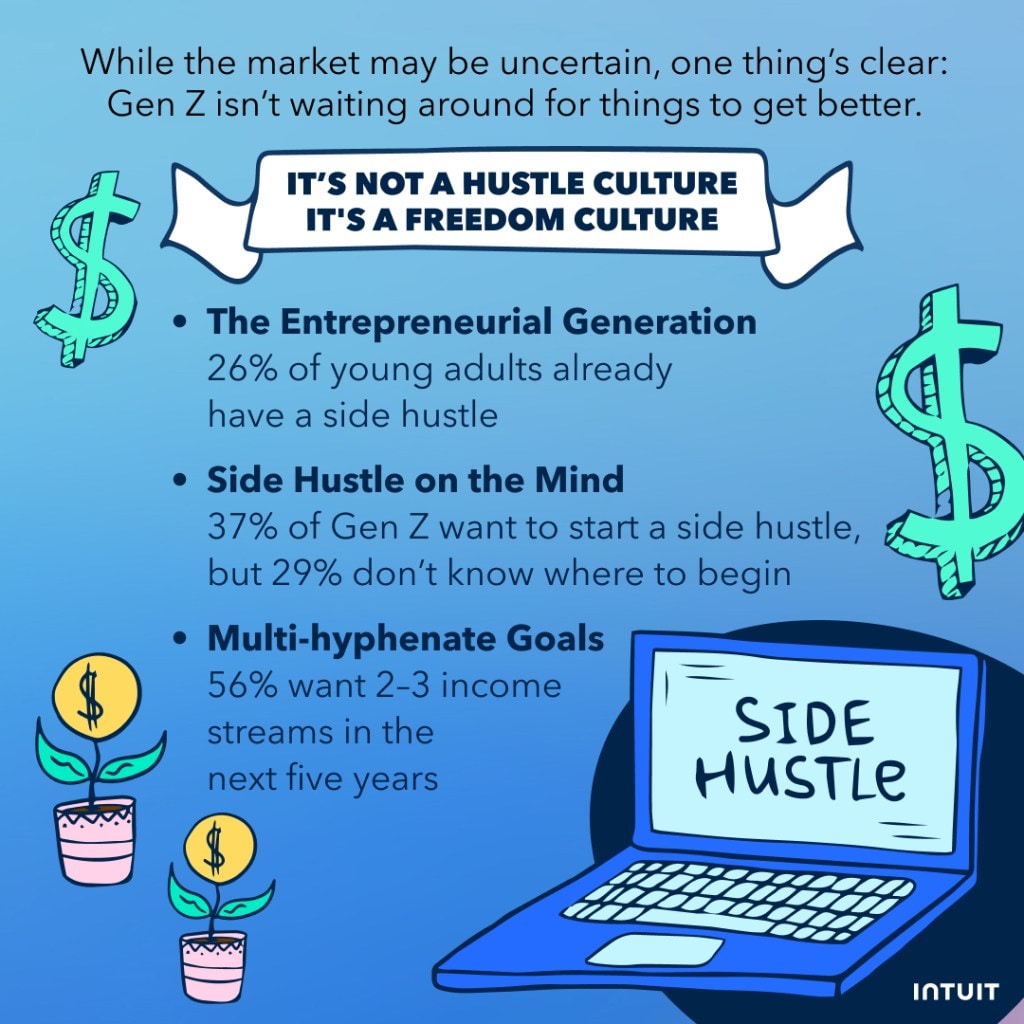

Side Hustles: The Modern Safety Net

In this economy, multiple income streams aren’t optional — they’re strategic. Side hustles are fast becoming the new norm. They’re how this generation is staying afloat, paying off debt, and creating a little extra breathing room. In 2022, I started a side hustle to quickly pay off student loan debt with no intention to keep working multiple gigs long-term, however, the majority of this generation sees multiple hustles as critical. In fact 26% of the respondents in our survey say they already have a side hustle.

And according to the data, this generation aims to have multiple income streams.

• 37% want to start a side hustle, but 29% don’t know where to begin

• 56% aim to have 2–3 income streams in the next five years

For this generation of blooming adults, money is a means to design a life that adapts to this moment allowing them more freedom, flexibility, and control.

The New Generation: “We Got This”

The Class of 2025 and those that headed out on their own or are navigating a new life-ing milestone, aren’t backing down. They know the financial road ahead is curvy—but they’re stepping up and making it happen anyway. They believe that prosperity can be built their way, even if it wasn’t handed to them. With resilience, drive, and a deep desire to create something better, they’re laying the foundation for a new definition of financial success — rooted in intention and adaptability.

At Intuit, we’re proud to be in their corner and we’re always looking for innovative solutions to improve our customers’ financial lives. The Intuit platform is here to make life-ing a little less overwhelming and a lot more empowering. Because prosperity isn’t about luck—it’s about access to financial education (like Intuit for Education), so everyone can find their own way to money and thrive.

Discover our new resource (intuit.com/lifeing), designed to offer practical guidance and tools that help young adults confidently manage their finances and build a secure future.

⸻ Methodology: In April 2025, Intuit commissioned an online survey of 1,500 U.S. consumers ages 18-25 (Gen Z) via Pollfish. Young Adults are defined as women and men ages 18-25 and are Gen Z.