New feature release! Live webinar 2/19 @ 11am PST Register now

Table of contents

Table of contents

Enterprise value meaning: Enterprise value is a financial reporting metric that considers both company equity and debt. This value would be the price to purchase the entire company, including all debt owed.

Understanding enterprise value is crucial to understanding the competitive landscape and potential acquisitions. For example, a critical factor in Google’s acquisition of YouTube in 2006 was understanding YouTube’s enterprise value, considering current numbers and future revenue.

Enhancing profitability is important in a growing mid-size business, and knowing how to leverage EV calculations is a part of that. Here, we'll explain what enterprise value is, explore use cases, and run through a real-world example.

Understanding enterprise value

Essentially, EV in finance is a company's total value, considering both equity accounts and debt. An EV can tell you:

- How much a company will cost to acquire, or how much your company will cost to be bought.

- Business valuation information for mergers.

- How your company is valued against competitors.

- If your company’s stocks are undervalued or overvalued.

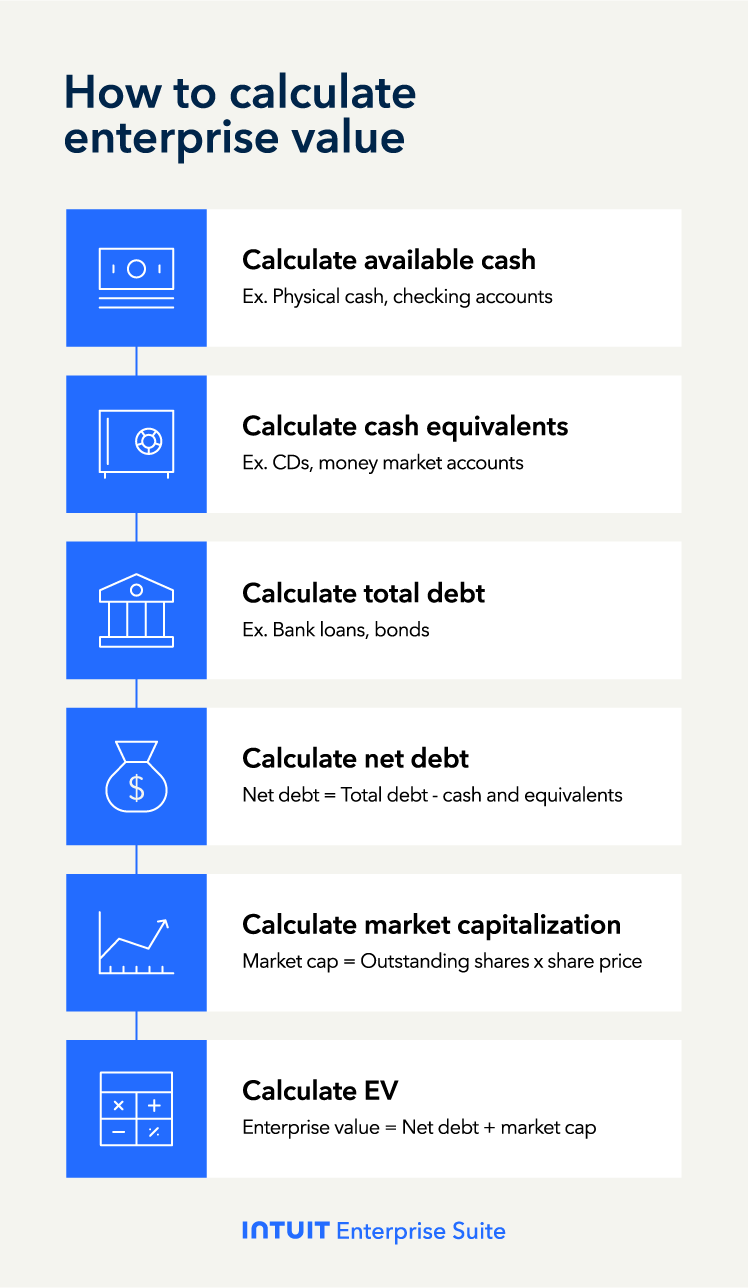

To calculate a company’s EV, you’ll need four key pieces of information, some of which can be found on your balance sheet: market capitalization, total debt, cash, and cash equivalents.

How to calculate enterprise value

Let’s tie all of this together with a real-world example to understand how to calculate enterprise value:

Let’s assume your company has the following information:

- Cash on hand: $7 million

- Cash equivalents: $2 million

- Total debt: $13 million

From here, we can start the total enterprise value equation by calculating your net debt:

Net debt = Total debt - cash on hand - cash equivalents

Net debt = $13 million - $7 million - $2 million

Net debt = $4 million

Now, to calculate your market capitalization:

- Outstanding shares: 5,000

- Share price: $100

Market capitalization = Outstanding shares x share price

Market capitalization = 5,000 x $100

Market capitalization = $500,000

Finally, let’s put it all together to calculate your enterprise value or the cost it would be to essentially purchase your business:

EV = Market capitalization + net debt

EV = $500,000 + $4 million

EV = $4.5 million

Therefore, your total enterprise value is $4.5 million.

Intuit Enterprise Suite customers are saying

"We’ve now been moved over to the Intuit Enterprise Suite. It has immediately solved the issues we’ve had as it relates to multi-entity. We were looking at something like Netsuite when all we need is consolidated financials and intercompany transfers via journal entries. Those needs are getting addressed now which is exciting for us."

- Matt Van Der Molen, CMO, Four Points RV Resorts

Enterprise value use cases

You’ve learned what enterprise value is and how to calculate it for your business. But what can you do with this information, and how can the EV formula benefit your company?

Financial ratios

Enterprise value is key to understanding your company’s overall financial well-being. A few ratios use EV and other financial values to determine total financial health.

Some of those ratios include:

- The EV/EBITDA ratio compares a business's EV to its earnings before interest, taxes, depreciation, and amortization (EBITDA) value.

- EV/Sales ratio depicts a company’s enterprise value against its total revenue.

- EV/FEC, which compares the EV to a company’s free cash flow.

Valuation methods

When valuing your company, it is vital to consider your enterprise value, as well as equity and debt, to get a holistic financial picture.

EV, along with the discounted cash flow (or DCF) analysis, is crucial to determining a business’s value. Here, your EV is considered a terminal value or the estimated future value of your cash flows beyond the projection period. These values can help determine your company’s intrinsic value or underlying worth.

Mergers and acquisitions

Enterprise value is a crucial financial figure when considering mergers and acquisitions. It helps provide a company's complete financial picture and determines the acquisition pricing, which is nice to have when considering such strategic moves.

Overall, having EV information can help business owners make informed decisions about mergers and acquisitions, particularly if they will make a decent financial investment.

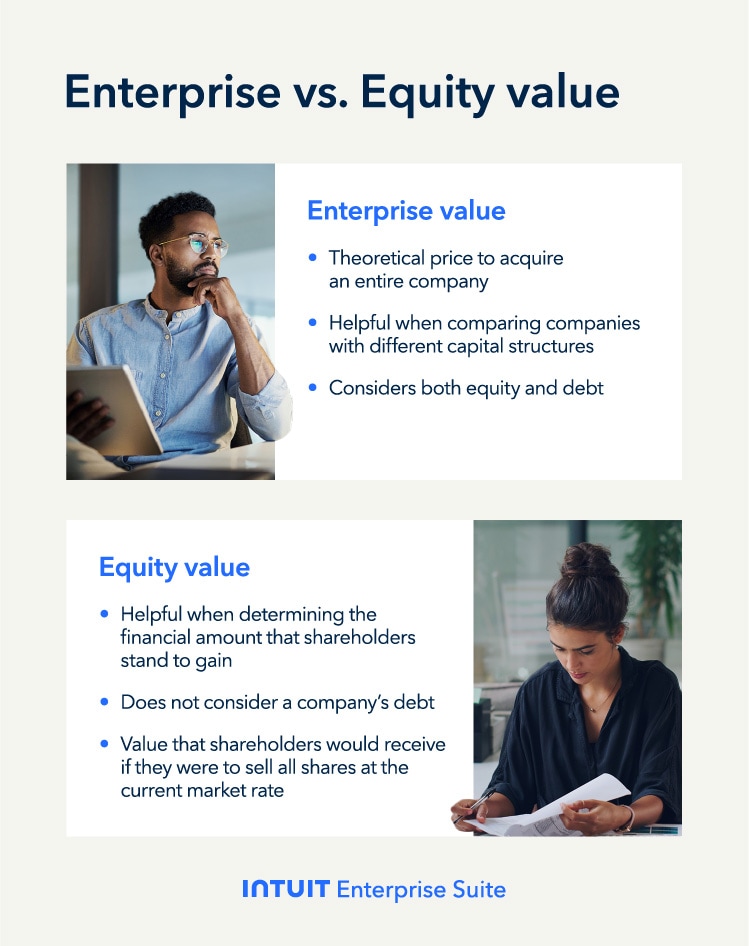

Enterprise value vs. equity value

While enterprise value and equity value are both used to determine a company’s business valuation, there are some differences between the two.

Enterprise value considers a business's market capitalization and net debt, taking into account both equity and debt.

Equity value is the result of taking the number of outstanding shares by the current market price per share. This is also known as market capitalization or market cap.

Another key distinction to make is between EV and the price-to-earnings (P/E) ratio. The P/E ratio focuses on the relationship between price and earnings by dividing the price per share by earnings per share. In comparison, EV provides a broader view of a company's overall value by considering both assets and debt.

Limitations of enterprise value

While understanding what enterprise value is and how it can give you a good overview of your company’s financial health, there are some limitations:

- Assumptions: Your enterprise value assumes that the given market will accurately value your future prospects.

- Qualitative information: While EV takes financial information into consideration, it doesn’t account for any qualitative factors like trends or competitive advantages.

- Short-term changes: Since the market cap is a major contributing factor, your EV can drastically change due to short-term market changes.

- Capital structure: Since debt plays a significant role, the EV value could be lower than expected, even if your business structure is thriving.

- Not for everyone: While EV is a great way to gauge your business's performance, it might not be a perfect indicator of financials for every industry, especially those with intangible assets like copyrights and other intellectual property (IP).

Thankfully, with the help of powerful financial tools, you can rest assured that these limitations will be minimal.

Boost profitability and enhance productivity

By keeping everything in one place, you can calculate your enterprise value and other vital financial numbers quickly and efficiently to raise your business equity. Utilize an all-in-one enterprise solution to access and leverage your company’s financial reporting easily.

Intuit Enterprise Suite customers are saying

"[Intuit Enterprise Suite has been] a solution for the thing that we needed right away, which is a consolidation of information, the ability to look across our organization, and get that data in a format so we could move quickly."

- Ed Sutton, Owner & CFO, MDR Realty LLC

What is enterprise value FAQ

Customer stories

Business growth guide: Proven strategies to scale your business

How FEFA Financial scaled up with Intuit Enterprise Suite (No ERP migration needed)

Case study: Fire & Ice transforms multi-entity challenges with Intuit Enterprise

Four Points RV Resorts review: Why they chose Intuit Enterprise Suite over NetSuite

Humble House Foods case study: How they improved visibility & simplicity using Intuit Enterprise Suite

More on acquisitions & mergers

Venture capital funding: What is VC funding, how to choose investors & negotiate equity

Horizontal integration: Definition, pros & cons, vertical vs. horizontal integration comparison