New feature release! Live webinar 2/19 @ 11am PST Register now

Table of contents

Table of contents

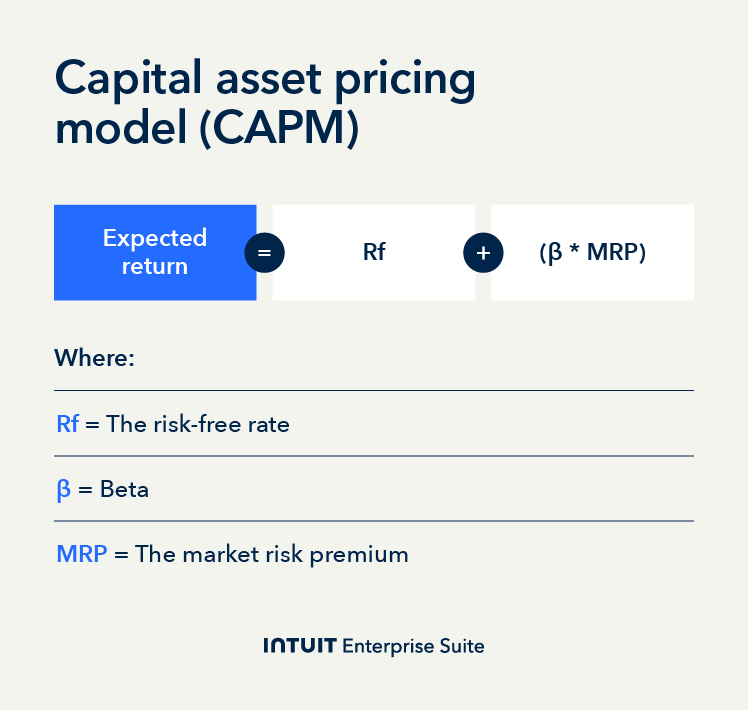

What is the CAPM formula? The capital asset pricing model (CAPM) formula is a model that calculates the expected rate of return on an investment. Using the formula you can calculate your expected return: Expected return = Rf + (β * MRP).

Knowing how to make the right investments is key to growing a business. It can help expand product offerings, penetrate new markets, and attract investors who are willing to play the long game.

The CAPM formula can help you figure out how much money you expect to make on your investment. This will help you decide if you should take the risk or not. Learn more about what makes up the CAPM formula and how to best leverage it for your business decisions.

CAPM formula components

The capital asset pricing model (CAPM) formula calculates an investment’s expected return using three main components: risk-free rate, beta, and market risk premium, resulting in the expected return.

- Risk-free rate: The theoretical rate of return of an investment with zero risk, often proxied by the yield on a long-term government bond, such as a 10-year Treasury bond.

- Beta: The measurement of a stock's volatility relative to the overall market, where 1 means the stock moves with the market, greater than 1 means it’s more volatile, and less than one means less volatile.

- Market risk premium: Anything additional that investors stand to earn by investing in the overall market, calculated as the difference between the expected market rate and the risk-free rate.

How to calculate CAPM

The CAPM formula is:

Expected return = Rf + (β * MRP)

In this equation, Rf is the risk-free rate, β is beta, and MRP is the market risk premium. To use the CAPM formula:

- Determine the risk-free rate by identifying a suitable government bond yield. Most often, the 10-year Treasury bond is used.

- Determine beta by using historical data to estimate beta against a market index like the S&P 500.

- Identify the market risk premium, which financial analysts often provide estimates for.

- Plug values into the formula to calculate the expected return on investment.

Your returned value, or expected return, will be the estimated annual return on investment or asset. While there are no set “rules,” a double-digit result is considered good, and most land between 10% and 15%.

A single-digit result might be acceptable for lower-risk investments but should be heavily inspected against other valuation methods to ensure you’ve made a suitable investment.

Example of calculating expected return using CAPM

Let’s assume the following information:

- Risk-free rate (Rf): 2.5% (This could be the yield on a 10-year government bond)

- Market risk premium (MRP): 6% (The expected return on the market portfolio above the risk-free rate)

- Beta (β): 1.1 (The stock's volatility relative to the market)

Using our formula for CAPM:

Expected Return = Rf + (β * MRP)

Expected Return = 2.5 + (1.1 * 6)

Expected Return = 2.5 + 6.6

Expected Return = 9.1%

This means that your investment or asset will see a return of 9.1% annually.

Applications and considerations for the CAPM

The CAPM model is one of many accounting formulas that has various use cases:

- Investment performance evaluation: CAPM can be used to compare the portfolio’s actual return to its expected return to evaluate total performance.

- Asset valuation: CAPM can help to determine the fair value of an asset or investment for financial forecasting purposes.

- Cost of capital: The CAPM value is used to estimate the cost of equity capital. This value is used in calculating the weighted average cost of capital, which is the minimum rate of return that a company must earn on its investments to satisfy its investors.

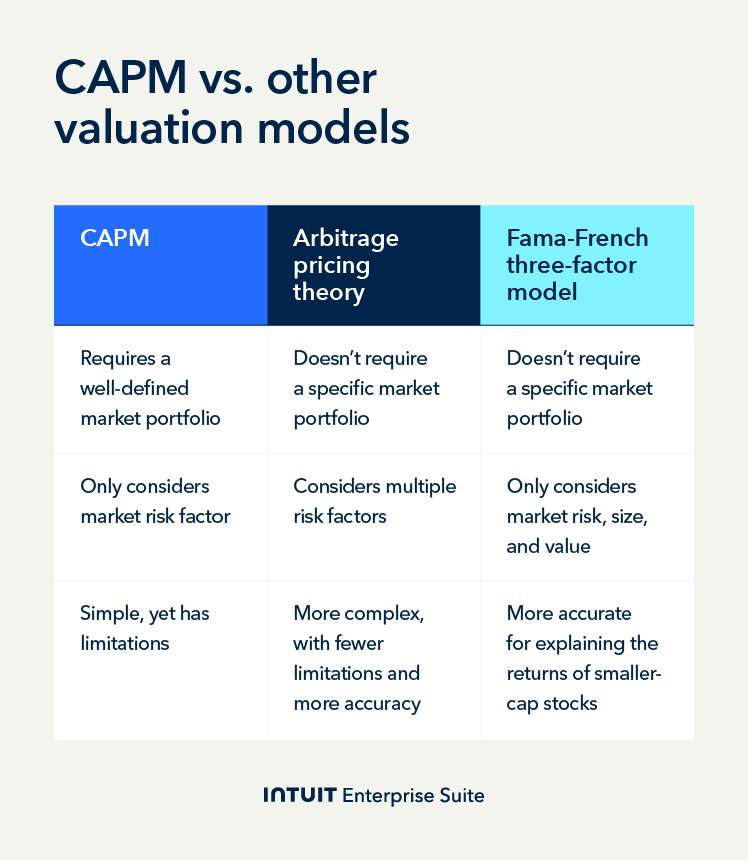

CAPM vs. other valuation models

CAPM isn’t the only model you can use to evaluate your potential return on investment or asset.

- CAPM vs. arbitrage pricing theory (APT): While both models determine the expected return of an investment, APT is more complex and uses multiple risk factors.

- CAPM vs. Fama-French three-factor Model: CAPM only considers market risk, whereas the Fama-French three-factor Model looks at market risk, size, and value.

- CAPM vs. dividend discount model (DDM): These two models are often used together. The CAPM model provides the required rate of return for the DDM, which DDM uses to discount future dividends.

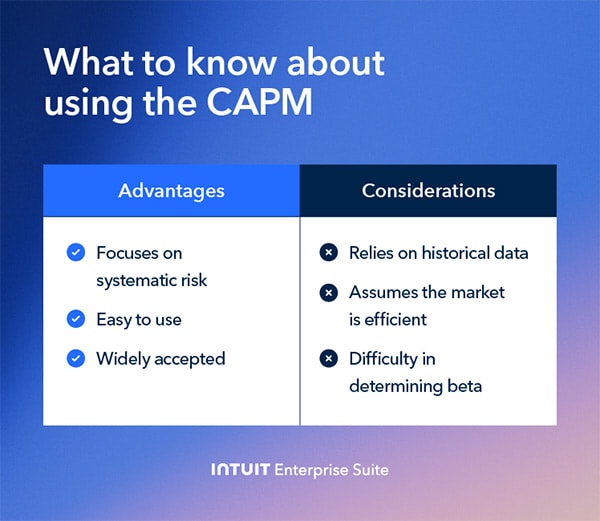

Limitations of using CAPM

While CAPM is a valuable financial metric in understanding the relationship between risk and return, it has limitations. First, CAPM assumes several figures, such as the risk-free rate and market value. As these fluctuate and change, the actual value may not be represented within the formula. CAPM is designed for equity investments, but using it for fixed-income securities will yield incorrect values.

Additionally, beta estimation considers historical data — however, history isn’t always the best predictor of present or future doings. Also, market anomalies exist because the model assumes all information is immediately shown in market pricing. And while the model considers systematic risk, it does not consider other factors influencing asset returns, like firm value.

Although there are several limitations, CAPM is still a valuable tool in the toolbox for evaluating investments and identifying risk.

Tips for using the CAPM

While you cannot predict every limitation that the CAPM formula could have, there are some tips you can use to make its value the most accurate:

- Use reliable data sources to source your historical returns and risk-free rates.

- Understand practical considerations of the formula, such as company-specific factors and competitive advantage.

- Periodically review and update CAPM to reflect market changes.

- While CAPM is valuable, it’s most useful when integrated into a comprehensive business strategy.

Intuit Enterprise Suite customers are saying

"[The dashboards] having all of that data available and bringing intelligence to it to help point our eyes to things that we could be missing—this is the game changer."

- Ed Sutton, Owner & CFO, MDR Realty LLC

Enhance profitability with integrated, robust financial management

Leveraging the CAPM formula can help you understand the expected return of an investment based on its risk value. Unsurprisingly, understanding financial projections is easier with the right tools. Let Intuit Enterprise Suite help you enhance your business’s profitability with easy-to-use financial management capabilities at your fingertips.

CAPM formula FAQ

Customer stories

How FEFA Financial is growing with Intuit Enterprise Suite—without migrating to an ERP

How this mission-driven, employee-owned company created efficiencies with Intuit Enterprise Suite

Why this camping business chose Intuit Enterprise Suite over NetSuite

Migrating to Intuit Enterprise Suite took 2 hours (with zero disruption) for this aspiring $50M revenue business