New feature release! Live webinar 2/19 @ 11am PST Register now

Table of contents

Table of contents

What’s new for July 2025

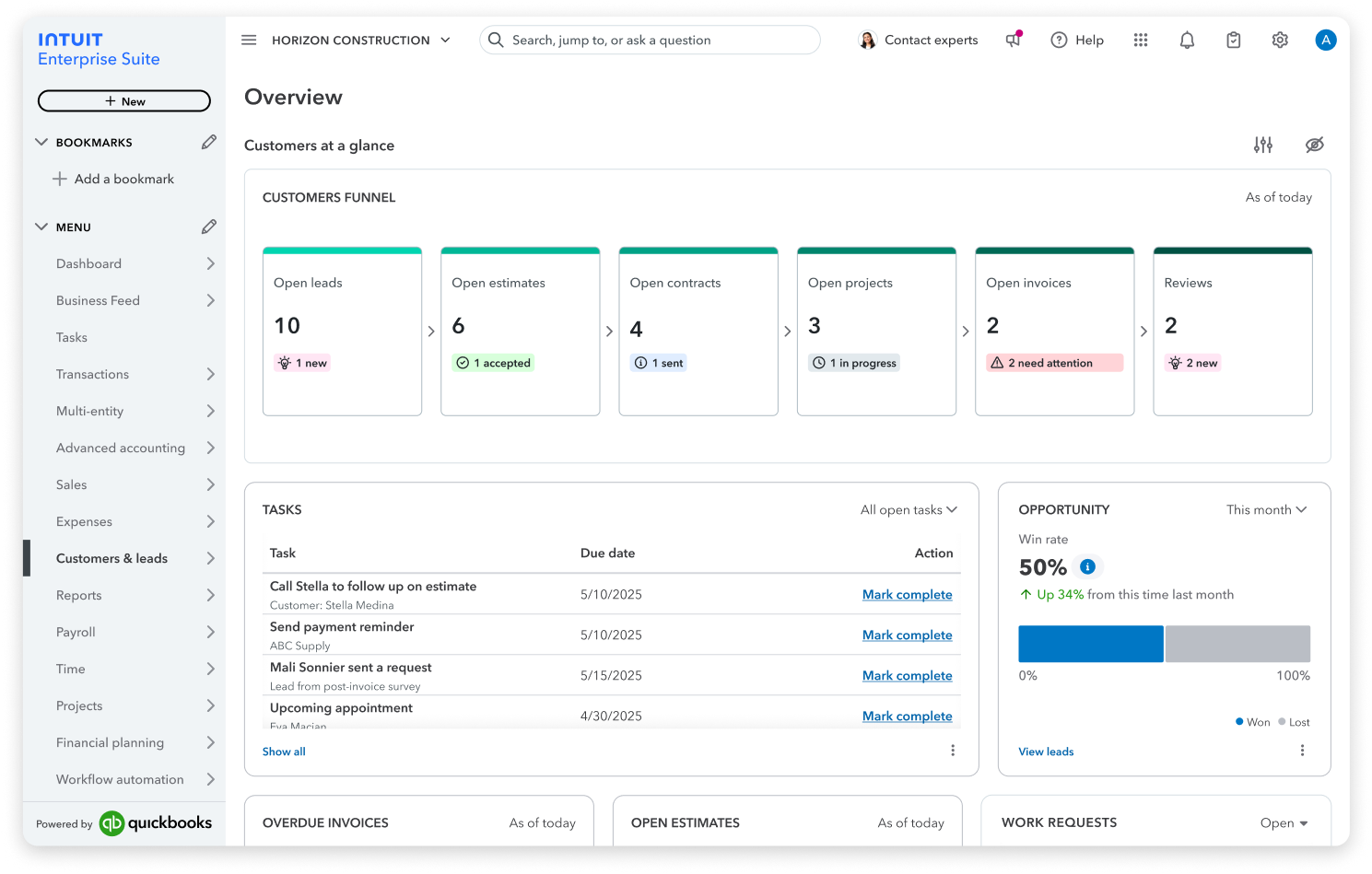

If your business is focused on growth, the summer Intuit Enterprise Suite update helps you meet complex financial planning and budgeting needs. The release adds new AI agents and other automations to help streamline your day-to-day work, dashboards and reports, and additional industry customizations that give you better visibility and control. Whether you manage one enterprise or many, here are the latest additions and improvements to help support your ongoing growth.

Automate tedious financial, accounting, and payment tasks with new AI Agents

Intuit’s AI agents help you focus on what’s important. These new agents act as intelligent business partners, transforming financial performance management from a reactive, time-consuming process into an efficient driver of growth and profitability.

74% of customers say Intuit AI gives them a better picture of their business’s financial health.1

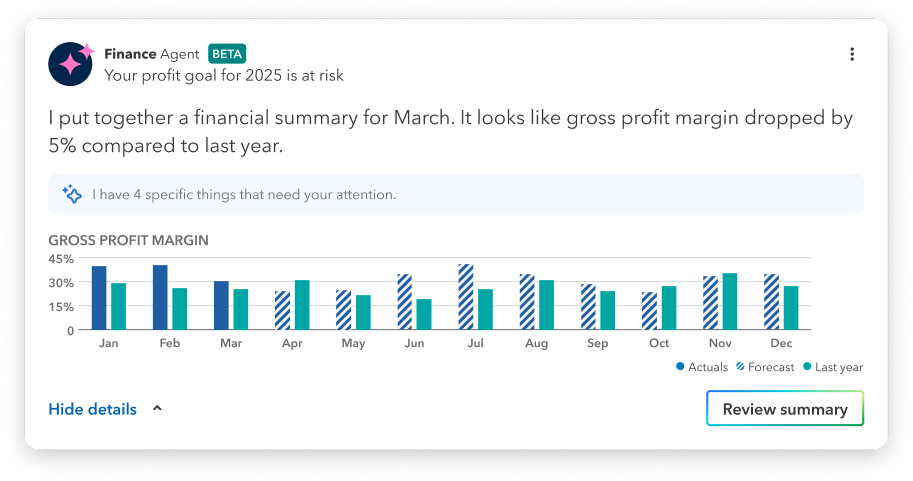

Finance Agent

The new Finance Agent helps improve productivity, decision-making, and profitability. It helps you steer clear of costly mistakes through proactive risk management tools. A few of the tasks the Finance Agent can do include:

- Continuously monitoring financial performance and proactively identifying anomalies, trends, and deviations from your goals and budgets.

- Analyzing performance across key metrics and projecting potential variances from your existing forecast.

- Using an assisted panel to get quick answers and detailed drill-downs for your financial performance questions.

Project Management Agent

The new Project Management Agent automates your projects from start to finish. It creates estimates, sets up project details, plans, tasks, and suggests profitability targets. Plus, it builds summaries with insights and recommendations, so you can improve how profitable your projects are in the future.

Accounting Agent

The new Accounting Agent saves time previously lost on tedious bookkeeping tasks, with notable accuracy in a fraction of the time. This AI agent automatically categorizes and populates transactions and matching suggestions with explanations.

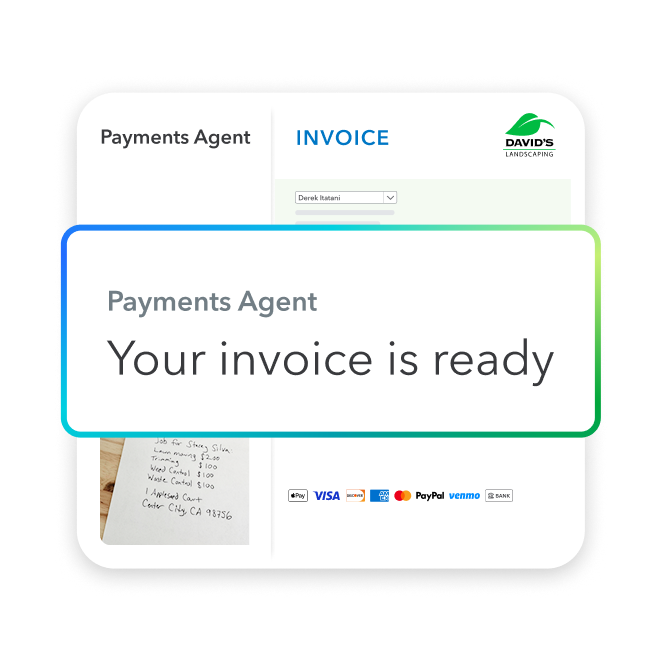

Payments Agent

The new Payments Agent uncovers more efficiency and better money outcomes by automating and streamlining payment collection. This AI agent analyzes your customers’ behaviors and implements hyper-personalized payment strategies to accelerate cash flow—including recurring payments, invoice reminders, deposits, and late fees.

- Use the agent to automatically draft and send personalized messages that share new payment options.

- Get an assessment of your business’s cash flow and uncover the most effective payment levers you can pull to improve it.

- Tailored payment strategies that increase invoices paid in full, strengthen customer relationships, and provide visibility into your cash flow.

Get paid 5 days faster on average when you send invoice reminders with

Intuit AI.2

Multi-entity financial management

Finance teams at multi-entity businesses manage exponential levels of complexity. Intuit Enterprise Suite lets you manage multiple entities, users, and locations from one place, and connect your finances, payroll, payments, workforce, and marketing on one platform. You can gain real-time visibility into financial performance across all entities — without having to navigate to each entity. Here are the latest updates:

New multi-entity reports and enhancements

Streamline your multi-entity reporting and better manage your cash flow for more flexibility, productivity, and profitability. AI-powered insights pulled from individual and consolidated reports surface trend changes to be aware of, visualize historical data, and list contributing factors with links for further exploration.

You also get a comprehensive view of your multi-entity business’s AP, AR, vendor expenses, and transactions with new consolidated reports.

Intuit Enterprise Suite provides more granular control, deeper insight and greater customization with new reporting enhancements, such as centralizing data with shared lists and drilling-down to the transaction level from high-level multi-entity summary reports.

Done-for-you multi-entity allocations

Intercompany accounting at scale, simplified: avoid manual processes by automatically allocating intercompany transactions. Intuit Enterprise Suite will learn from prior transactions to proactively suggest intercompany allocations for bills, expenses, checks, and bank feeds, letting you review and modify as needed.

Allocations can now be calculated based on percentage of sales, expenses, or assets across relevant entities down to the item, product, or service level. Plus, extend intercompany journal entry permissions to create these transactions to more users, and add the ability to save a draft intercompany transaction.

"We felt like Intuit Enterprise Suite was the best system to allow us to grow and support a large number of organizations underneath us without a large staff. So, being efficient in staffing was a major driver of the investment."

- Founder and CFO, Landscaping / Construction

Business Intelligence

The summer release equips users with robust business intelligence tools, facilitating deeper financial insights and strategic planning. These new features will enable users to easily monitor business performance, surface key trends, provide comprehensive foresight into financial health and improve the accuracy and efficiency of their reporting and analysis.

AI-powered report insights

Free up valuable time and help drive business growth by optimizing financial statement review to find data-backed, actionable insights—at the speed of AI. Quickly identify trends and anomalies in your consolidated reports using your latest data without relying on manual interpretation of financial statements.

Intuit Enterprise Suite business intelligence surfaces changes in trends you should be aware of, along with more detail in a visualization of historical data and a list of contributing factors with links for further exploration.

78% of customers agree that Intuit AI allows them to spend more time growing their business.3

KPI Scorecard

Align your team to one set of objectives and enhance strategic accountability with a comprehensive set of KPIs that provides a complete overview of financial health and performance.

Track your business’s performance quickly and effectively by building a customized scorecard of key performance indicators using an exclusive library of 30+ pre-defined KPIs across growth, profitability, cash flow, liquidity, and efficiency measures. (Functionality available at the entity level only).

Advanced FP&A

See complex data clearly with multi-dimensional reporting and advanced FP&A. Cash flow forecasting offers detailed transaction data and editable projections. Integrate Profit and Loss, Balance Sheet, and Cash Flow Statements with three-way forecasting to make informed decisions for growth. (Functionality available at the entity level only).

Industry-specific customizations

New industry-specific customizations will enhance project and financial management for project-based businesses. We’re introducing the ability to request deposits on estimates, which gives businesses greater flexibility to secure payments, with accurate accounting for these liabilities. Users will be able to draft, lock, and version budgets for their projects with enriched project budgeting capabilities, providing comprehensive tracking of estimated versus actual costs and immediate notifications for potential overruns.

A new employee cost calculator streamlines the determination and application of employee cost rates. It integrates automatically with QuickBooks Payroll for improved accuracy and efficiency in project profitability analysis. (Excludes overtime cost rates).

Broader platform enhancements

This release also includes broader ecosystem enhancements designed to improve overall platform functionality and user experience. New payroll features, such as effective dating for pay types, paycheck corrections for closed quarters, and comprehensive employee compensation enhancements, will provide greater flexibility and accuracy in managing employee payroll. A new Customer Hub will centralize customer relationship management, allowing businesses to organize notes, track leads, schedule appointments, and send contracts for e-signature.

We are also making significant platform performance enhancements to ensure a more responsive experience for businesses with high transaction volumes or multiple entities, alongside a new global search experience that enables natural language queries and advanced filtering for faster, more intuitive information retrieval.

When you schedule a demo, you agree to permit Intuit to use the information provided to contact you about Intuit Enterprise Suite and other related Intuit products and services. Your information will be processed as described in our Global Privacy Statement.

Disclaimers

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

# Claims

1. 74% of customers say Intuit AI gives them a better picture of their business's financial health: Based on a survey commissioned by Intuit of QuickBooks Online customers using Intuit Assist as of November 2024

2. Get paid 5 days faster on average when you send invoice reminders with Intuit AI: Based on U.S. Intuit Assist Beta customers using outstanding invoice notifications and AI-drafted invoice reminder features, compared to customers sending standard invoice reminders to the same customers, from January 2024 to August 2024. Not available in QuickBooks Online Advanced.

3. 78% of customers agree that Intuit AI allows them to spend more time growing their business: Based on a survey commissioned by Intuit of QuickBooks Online customers using Intuit Assist as of November 2024

Customer stories

How FEFA Financial scaled up with Intuit Enterprise Suite (No ERP migration needed)

Case study: Fire & Ice transforms multi-entity challenges with Intuit Enterprise

Four Points RV Resorts review: Why they chose Intuit Enterprise Suite over NetSuite

Migrating to Intuit Enterprise Suite took 2 hours (with zero disruption) for this aspiring $50M revenue business

Humble House Foods case study: How they improved visibility & simplicity using Intuit Enterprise Suite

More product updates

What’s new in Intuit Enterprise Suite spring 2025

Intuit Enterprise Suite 2025 update: AI agents & automation enhancements