Table of contents

Table of contents

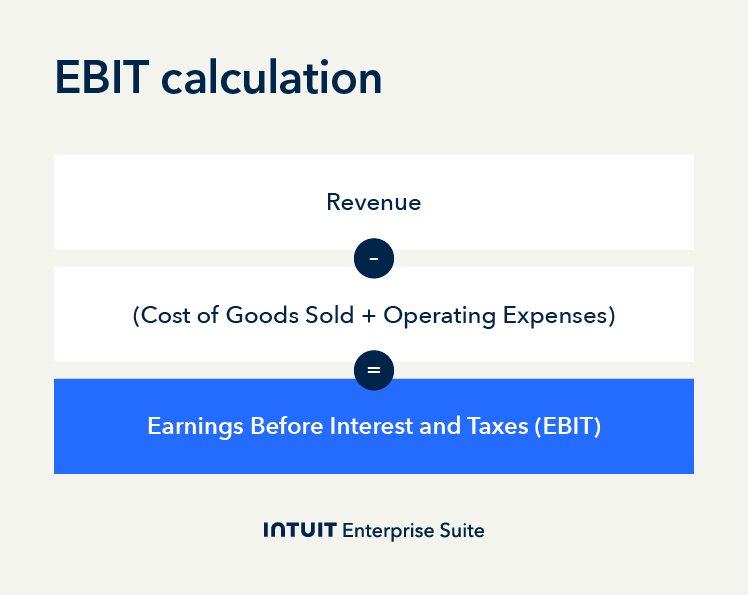

What is EBIT? Earnings before interest and taxes (EBIT) is a measure of a company’s profitability that excludes interest and tax expenses. It provides insight into operating performance, helping businesses and investors assess how well a company generates profits from its primary activities.

Understanding your business’s core performance can feel like a guessing game. You deal with sales, expenses, and maybe even debt—but how can you truly know if your operations are profitable? This is where earnings before interest and taxes (EBIT) come in.

By focusing only on revenue and operating costs, EBIT gives you a clearer picture of your company’s operational strength, helping you make better decisions without the noise of financing or tax details.

Learn what EBIT means and how to calculate it. We’ll also discuss why EBIT matters for assessing core profitability and how it can guide smart, growth-oriented choices.

Understanding EBIT

EBIT is a key metric that shows how much profit your business makes from its main operations alone. By excluding both interest expenses (from any loans or financing) and small business taxes, EBIT gives a straightforward view of how efficiently your core operations are running. For small business owners, this makes it a useful tool to assess performance without being influenced by financial or tax structures.

In simple terms, EBIT is what remains after you deduct everyday operating costs—like rent, wages, utilities, and other overhead costs—from your total revenue. This figure is a clear indicator of your business’s profitability from what you sell or produce, helping you focus on improvements where they matter most: in your core business activities.

How to calculate EBIT with an example

EBIT focuses on operating profits by leaving out interest and tax expenses. This is unlike net income, which is your total profit after all costs, interest, and taxes are deducted.

Think of EBIT as a measure of your business’s core performance, while net income reflects the “bottom line” after every expense. Here’s the EBIT formula:

Revenue − (Cost of Goods Sold + Operating Expenses)

A quick breakdown of how to calculate EBIT:

- Start with total revenue: This is the total income your business earns from sales or services.

- Subtract cost of goods sold (COGS): This includes direct costs like materials and labor to make your products.

- Deduct operating expenses: Take away operating costs like rent, wages, utilities, and administrative expenses.

Let’s say your small business earned $200,000 in total revenue last year. Your COGS came to $80,000, and your operating expenses were $50,000.

So, your EBIT is $70,000, which represents your business’s profitability from core operations alone.

Why is EBIT important?

EBIT in accounting highlights the profitability of a company’s core operations. We mentioned earlier that it reveals how well your primary activities perform on their own, but here are some other reasons why EBIT matters:

- Focuses on core performance: By leaving out interest and taxes, EBIT zeroes in on your business’s main activities. It shows how well you generate profit from what you sell or produce, giving a clear picture of operational efficiency.

- Draws easier comparisons: EBIT allows you to compare your business with others, regardless of financing or tax strategies, which can vary widely. For example, two companies in the same industry can have similar EBIT figures even if one has high interest expenses or tax advantages.

- Assesses financial health: EBIT helps you assess your business’s financial health by indicating whether core operations are profitable. If your EBIT is consistently positive and growing, it’s a good sign that your business is performing well. A declining or negative EBIT, on the other hand, could signal operational issues that need attention.

- Supports investment decisions: Investors often use EBIT to evaluate a company’s operating performance and growth potential. A strong EBIT suggests that the business is profitable at its core, making it more attractive for investment and less risky for creditors.

- Acts as a decision-making tool: With a clear picture of operational profitability, EBIT can guide you in making cost-cutting or reinvestment decisions. If your EBIT is below industry averages, you might look into areas where you can streamline costs or boost efficiency.

EBIT vs. EBITDA

EBITDA is earnings before interest, taxes, depreciation, and amortization. While both EBIT and EBITDA measure profitability, there are a few key differences:

- Focus on cash flow: EBITDA provides insight into cash flow by ignoring non-cash expenses like depreciation, whereas EBIT is better for assessing operational efficiency.

- Cost of assets: EBIT reflects the cost of owning assets through depreciation and amortization, making it more realistic for companies with significant capital investments.

- Profitability vs. cash flow: Use EBIT when you need a clear picture of core profitability. Use EBITDA when you want to understand a business’s cash-generating ability.

Limitations of EBIT

While EBIT is useful for understanding a business's core operating performance, it has limitations. EBIT doesn’t account for capital structure or tax impacts, which can be essential for fully assessing financial health.

For instance, net operating profit after tax (NOPAT) offers a more comprehensive view by factoring in taxes, giving a closer look at after-tax efficiency than EBIT alone.

EBIT often falls short in these scenarios:

- High debt levels: Companies with significant debt might show strong EBIT, but interest expenses on their income statements could reveal a different story. In such cases, EBIT may not accurately reflect the impact of debt on overall financial health.

- Capital-intensive industries: EBIT might overstate profitability for industries with high asset depreciation costs. Here, EBITDA can sometimes provide a better measure of cash flow, especially where depreciation expenses significantly impact net income.

- Tax implications: Because EBIT excludes taxes, it can miss the full effect of tax structures on profitability. NOPAT, which includes taxes, can provide a fuller picture, especially when comparing companies in different tax environments.

Important EBIT parameters

You can analyze EBIT in multiple ways to better understand your company’s operating performance. Looking at EBIT margins, EBIT growth, and EBIT-to-interest ratios can help you thoroughly assess profitability, growth potential, and financial stability.

EBIT margin (EBIT divided by total revenue) shows the percentage of sales that becomes operating profit. This ratio reveals how efficiently your business turns revenue into profit and can help you track operational effectiveness over time.

Tracking EBIT growth year-over-year offers insight into how well your business is scaling. A rising EBIT signals growing operational profits, while a declining EBIT may highlight underlying issues that need addressing.

EBIT-to-interest ratio measures how easily your EBIT can cover interest expenses, offering a view of financial stability. Higher ratios indicate strong earnings relative to debt costs, which is especially helpful for businesses considering additional financing.

Navigate midsize business challenges and opportunities

EBIT offers a solid measure of operating health, but using it alongside formulas tailored for small and midsize businesses, like net profit margin or asset turnover ratios, can provide a fuller picture of your financial status.

Whether you’re aiming to enhance profitability or preparing for future growth, having the right financial insights is essential. With the features available in QuickBooks for medium-sized businesses, you’ll find advanced tracking and analytics to manage all aspects of your operations. For more insights on handling financial health, check out our guide on core small business accounting formulas to expand your toolkit for smart decision-making.

Check out upcoming events and learn more about Intuit Enterprise Suite.

Customer stories

Case Study

How FEFA Financial is growing with Intuit Enterprise Suite—without migrating to an ERP

Case Study

How this mission-driven, employee-owned company created efficiencies with Intuit Enterprise Suite

October 25, 2024

Case Study

Why this camping business chose Intuit Enterprise Suite over NetSuite

October 25, 2024

Case Study

Migrating to Intuit Enterprise Suite took 2 hours (with zero disruption) for this aspiring $50M revenue business

April 25, 2025

Case Study

Humble House Foods case study: How they improved visibility & simplicity using Intuit Enterprise Suite

September 24, 2025