New feature release! Live webinar 2/19 @ 11am PST Register now

Table of contents

Table of contents

What is a financial controller? A financial controller is a senior-level executive of a business that is in charge of overseeing day-to-day financial operations. This includes financial forecasting, analysis, reporting, and regulatory compliance.

Hiring a financial controller for your growing business isn’t only a wise move—it’s almost necessary. This important business position is in charge of a business’s day-to-day financial operations, making sure the company runs smoothly from a financial standpoint.

Hiring a financial controller to handle daily operations lessens the chief financial officer (CFO)’s overall workload, freeing them to focus on the financial strategy aspects of the business. Below, we discuss the importance of the financial controller role and when a company might require one.

What is a controller in finance?

The financial controller sits directly underneath the CFO, along with the treasurer and internal auditor. In most midsize businesses and enterprises, the controller directly manages:

- Managerial accountants

- Financial accountants

- Tax accountants

The financial controller role has evolved in businesses throughout the years—what started as a basic accountant role has transformed into a position with financial strategy at its forefront.

Besides taking care of all necessary financial reporting measures, controllers leverage data analytics to learn more about the business’s financial standing. They are also responsible for identifying and assessing any financial risks and bringing solutions to the CFO. To do their job effectively, controllers require:

- Technical expertise

- Analytical skills

- Problem-solving skills

- Communication skills

Core financial controller responsibilities

The financial controller plays an essential role in a successful business. This highly technical role requires someone with mathematical and critical thinking skills to understand the business’s financial statements and position, as well as to explore new financial strategies.

Financial management and reporting

One of the traditional day-to-day controller responsibilities includes the financial management and reporting of the business. This involves:

- Preparing monthly/quarterly/annual financial statements

- Budget preparation and monitoring

- Cash flow management

- Financial forecasting and analysis

- Development of financial strategy alongside CFO

Operational oversight

Finance controllers also have operational oversight, giving them critical access to making more efficient and cost-effective business decisions. Some essential operational-level responsibilities of the controller include:

- Leading and implementing team management processes

- Understanding business process improvement

- New technology implementation, like ERP solutions

- Identifying risk management

Compliance and control

Maintaining compliance is crucial for a business’s legal and financial situation, which is why it's a large part of a financial controller’s job. This includes:

- Managing internal control systems

- Maintaining regulatory compliance

- Performing audit management

- Developing efficient financial policies

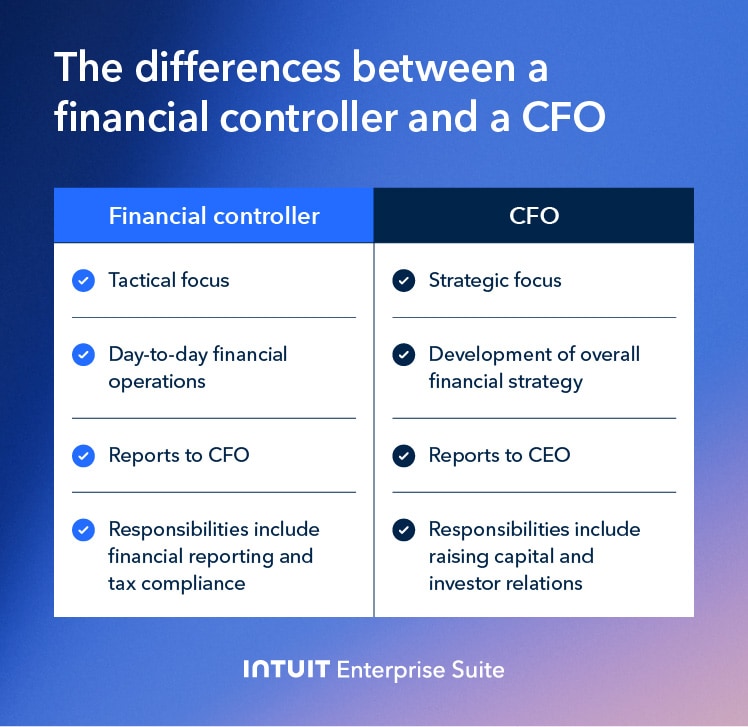

Financial controller vs. CFO: Key differences

While CFOs can handle a business’s significant financial processes, there are some key differences between them and a financial controller. Most notably, a CFO reports to the CEO of a company, whereas the finance controller reports to the CFO on behalf of the accounting team.

Additionally, financial controllers tend to have more of a day-to-day role within the company. In contrast, the CFO takes on more long-term external-facing responsibilities, like raising capital for the business.

When a company only has a CFO to make financial decisions, the CFO position becomes more hands-on than customarily required. The CFO oversees more operational aspects of the business, like team leadership and development, in addition to external financial relationships.

When does your business need a financial controller?

A business might not need a financial controller right away—up until a certain point, operations can be quite successful, with a CFO managing the company’s daily financial responsibilities. However, there are specific scenarios where adding a financial controller can help the CFO and the company overall.

Increased business complexity

The need to handle multiple financial doings simultaneously grows as your business grows. This increased need can be a significant task for one person, which is why having a CFO and a financial controller is wise. Situations where business complexity increases include:

- Expanding the business to multiple locations or opening the company to new markets

- Having multiple revenue streams

- Increased compliance requirements, including industry-specific needs

Growth indicators

Having a financial controller who can act as a liaison between the company’s financial teams and the CFO can be beneficial. A controller who can lead a large and growing accounting team can ensure accurate and efficient reporting.

Additionally, a growing business may require expert knowledge in areas like tax strategy or financial analysis, which a controller specializes in. Above all else, the financial controller would use tools and solutions that the CFO invests in, like a custom ERP solution, to make sure the company is using its software solutions wisely.

Other common signs

Sometimes, there are signs that the business needs the experience of a financial controller. While the CFO can handle these matters, it’s often best to bring in someone specializing in the business's tactical financial issues. These include:

- Difficulty meeting financial reporting deadlines or frequent errors within the financial records

- Company-wide accounting software upgrades where a subject matter expert would be helpful

- CFO burnout from being stretched too thin across multiple departments

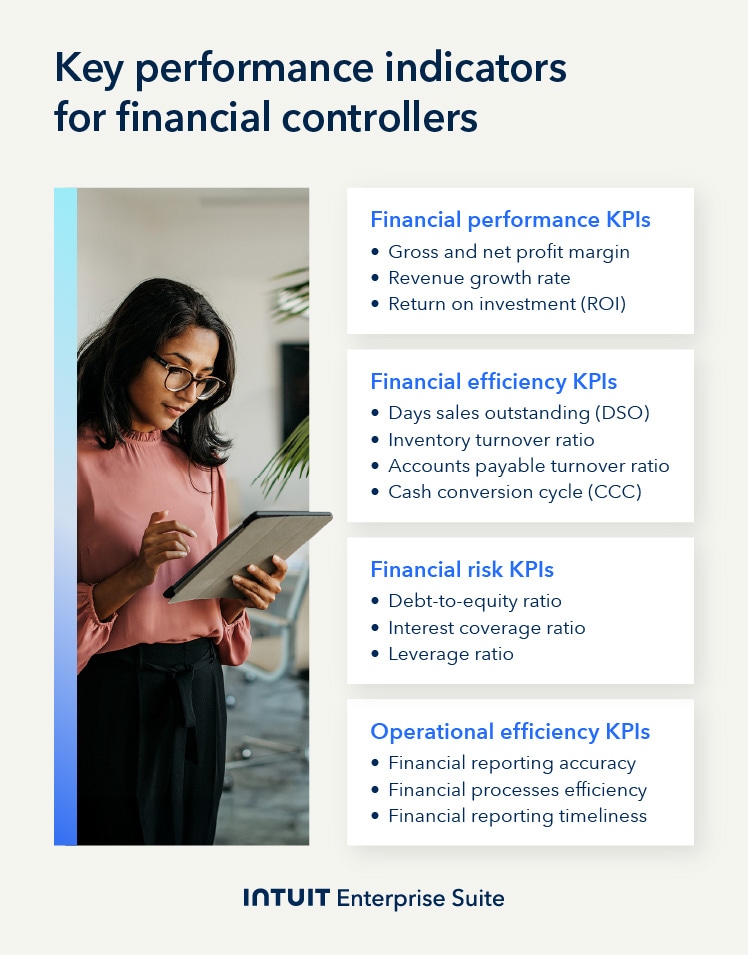

Best practices and strategies for success

Introducing a financial controller to your business is a smart move for company success and relieves some pressure from the CFO role. Controllers help guide the daily financial processes, ensure company compliance, and properly report to the entire C-suite.

Best practices when onboarding a financial controller:

- Set key performance indicators (KPIs) for the first 30, 60, and 90 days as benchmarks of success

- Build strong relationships across other company departments, like sales, operations, and HR, who will work alongside the controller

- Embrace technology by utilizing financial software to automate tasks and improve scalability

When you schedule a demo, you agree to permit Intuit to use the information provided to contact you about Intuit Enterprise Suite and other related Intuit products and services. Your information will be processed as described in our Global Privacy Statement.

Boost productivity and enhance profitability

Think of the financial controller as the CFO’s primary point of contact for the daily financial details of the business. Simplify the workflow with real-time financial insights and AI-generated forecasts from Intuit Enterprise Suite, allowing for efficient budget and cash flow tracking and easier financial management.

Customer stories

Case study: Fire & Ice transforms multi-entity challenges with Intuit Enterprise

How FEFA Financial scaled up with Intuit Enterprise Suite (No ERP migration needed)

Four Points RV Resorts review: Why they chose Intuit Enterprise Suite over NetSuite

Migrating to Intuit Enterprise Suite took 2 hours (with zero disruption) for this aspiring $50M revenue business