Imagine that you’ve joined the ranks of nearly 57 million self-employed workers here in the U.S., a growing and increasingly influential segment of today’s gig economy.

Within a few short months, it’s time to pay your estimated taxes—something you’ve never done before. So, you pick up a copy of IRS Publication 505, Tax Withholding and Estimated Tax, get a pencil and a piece of paper, and sit down to run the numbers. Then reality hits you. IRS publication 505 is 58 pages long, three columns wide, totaling more than 46,000 words—the size of a small novel—and only a small portion of what’s needed to get a complete picture of quarterly taxes in IRS 1040ES.

Calculating estimated taxes can be complicated.

To meet this and other needs unique to business consultants, freelance writers, contract programmers, ride-share drivers, and other gig workers, Intuit’s QuickBooks Self-Employed financial software uses AI and machine learning technology to automate time-consuming processes (expense tracking, profit and earnings forecasts, estimated tax calculations, etc.)

In a survey of QuickBooks Self-Employed customers earlier this year, we made an important discovery. Despite the fact that we were able to provide incredibly accurate quarterly tax estimates—using our customers’ data with permission—a lack of full confidence in the results emerged as one of their major pain points. They needed us to explain how we’d arrived at the estimate by “showing our work.”

Explaining the logic behind the numbers

Luckily, we knew exactly what to do.

Having solved a similar problem for TurboTax users a few years ago, we formed a cross-company mission team to apply the same solution to QuickBooks Self-Employed.

In under three weeks, the team integrated our Knowledge Engine (KE) platform into QuickBooks Self-Employed, bringing ExplainWhy into production in March 2019 as a standard feature.

Our next-generation Knowledge Engine is a breakthrough in the tax preparation industry. Designed specifically to support large-scale Q&A systems using advanced AI algorithms with knowledge representations underneathKE encodes more than 80,000 pages of U.S. tax compliance requirements into machine computable tax knowledge graphs and correlates them to myriad scenarios facing today’s tax filers.

A collection of algorithms finds what’s missing (complete data), what’s wrong (contradictions), and explains why (explaining recommendations). In this manner, KE minimizes and tailors the number of questions needed to provide—and explain back—computational results to our customers in a personalized way.

Unlike simple look-up systems, ExplainWhy interacts with the QuickBooks Self-Employed user via an incremental and interactive dialog. ExplainWhy generates progressive explanations that are logically related, allowing the user to drill down as far as needed to fully understand the numbers in just seconds.

Altogether, this results in a personalized, contextual, streamlined experience that boosts tax filer confidence.

“Are you sure?”—ExplainWhy in Action

Let’s say Uber driver Adriana uses QuickBooks Self-Employed to minimize the time she spends at her desk so that she can maximize her income-producing time behind the wheel. As April 15th approaches, Adriana clicks on the Quarterly Tax section to find out how much she should pay. The screen recommends a payment of $1,823—a big hit to her net income for the month. Needless to say, she’s a bit shocked.

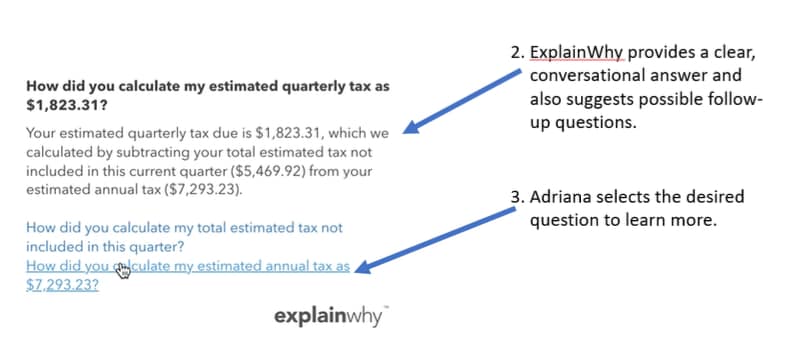

“$1,823? How can that be right?” she asks herself. That’s when Adriana notices the link titled “ExplainWhy,” right below the due date. Curious, she clicks. ExplainWhy provides a clear, conversational answer and also suggests possible follow-up questions. Within seconds, Adriana understands.

No one likes to pay quarterlies, least of all people struggling to make ends meet. But, we can mitigate one common source of worry for users by instilling trust throughout a simplified quarterly tax filing process. For Adriana and today’s growing contingent of gig workers, calculating and staying on track with quarterly tax payments isn’t so complicated after all—thanks to AI.