January has long served as the universal reset. It’s a time when many of us pause to reflect and set new intentions, whether it’s booking a dream trip, mastering a new skill, committing to a fitness routine, and of course, reevaluating our finances.

To better understand how Americans are approaching money in the new year, Intuit conducted a Financial Wellness survey to explore the real emotions and behaviors shaping how consumers save, spend, budget, and plan for 2026.

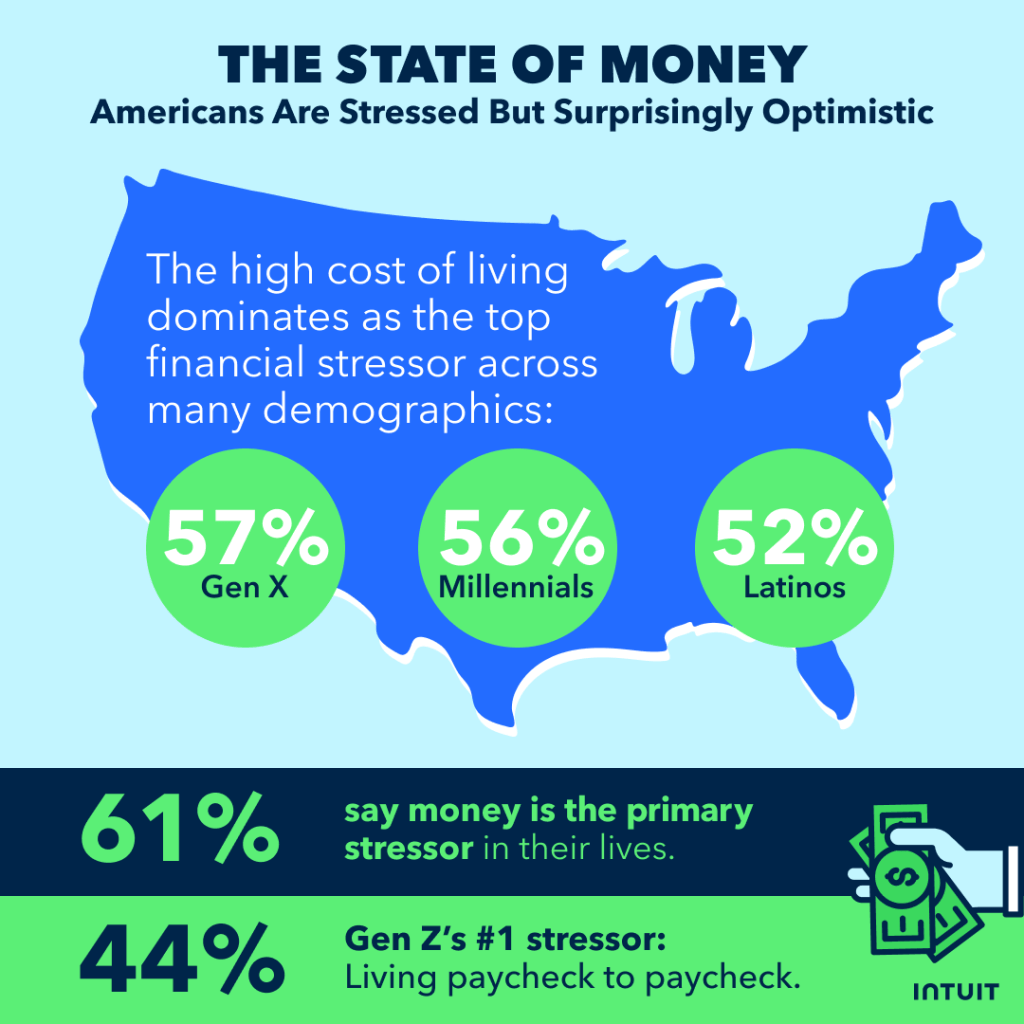

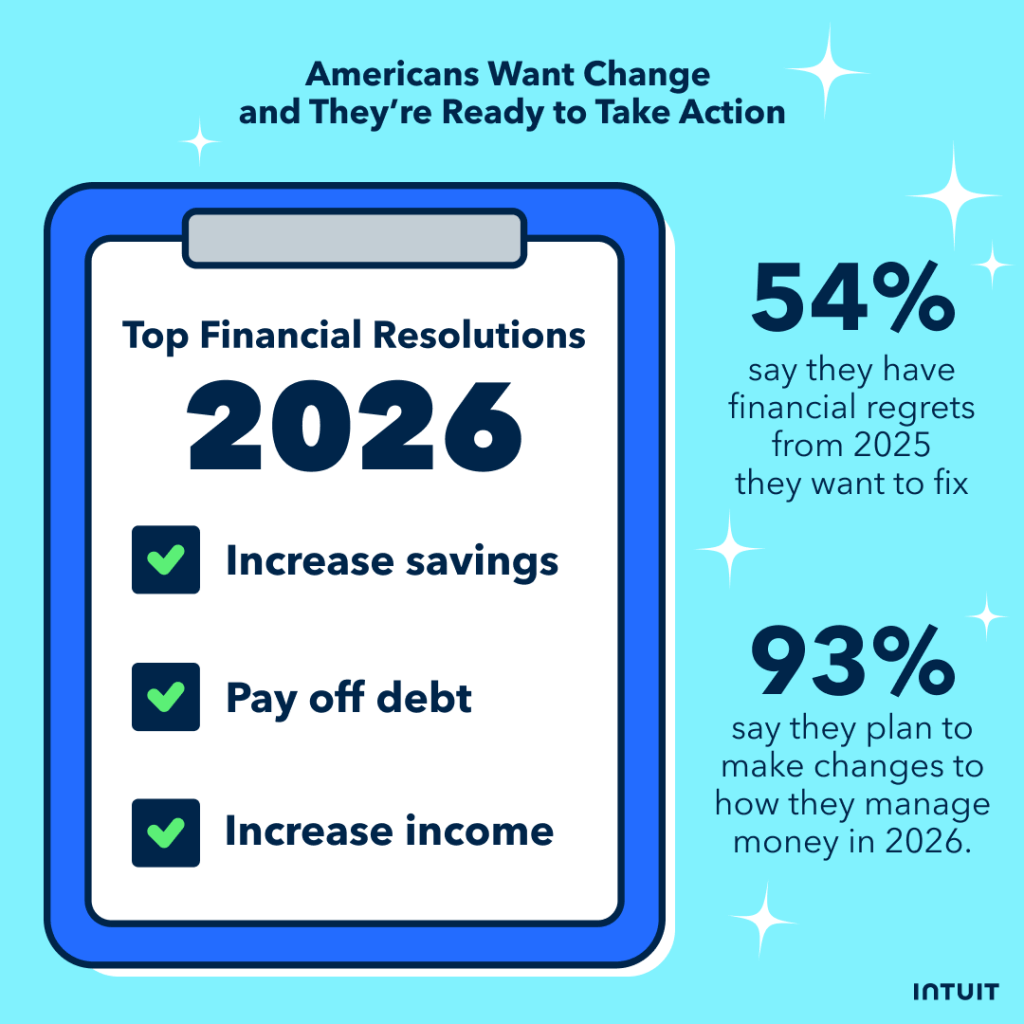

Rising costs and mounting daily expenses have ushered in a new era of financial realism, as 53% of survey respondents report an increase in financial stress over the past year, and 61% identify money as their primary life stressor. Despite these challenges, there’s a widespread readiness for a fresh start: More than half (54%) say they have financial regrets from 2025 they want to fix in 2026, and nearly everyone (93%) plans to make changes to how they manage their money in the new year.

But instead of only cutting back, people are responding with creativity, flexibility, and a renewed focus on making their money work with them — not against them. From the rise of mindful spending to the refusal to give up joy, 2026 looks to be the year consumers are turning to practical strategies, strategic trade-offs, and balanced approaches.

The State of Money: Americans Are Stressed — But Surprisingly Optimistic

While 30% of respondents describe their financial situation as just “getting by,” the rising cost of living remains the primary stressor for many (52%). However, the financial pressure points vary by generation: Gen Z feels the squeeze most acutely in their daily cash flow, with 44% citing the struggle of living paycheck to paycheck as their top concern. Despite these burdens, a surprising wave of optimism is taking hold. An impressive 76% feel confident that their finances will improve in 2026, signaling that while people are seeking relief, they still believe it is within reach.

Change Ahead: The “Little Treat” Crackdown and Rise of Mindful Spending

When it comes to 2026 priorities, Americans are focused on the fundamentals, as the top financial resolutions of the year include:

- Increase savings (21%)

- Pay down debt (20%)

- Boost income (15%)

With these resolutions comes a definitive action plan—one that entails minimizing participation in ‘little treat culture’ and a shift toward intention over impulse. 59% of consumers aim to cut back on small daily purchases, perhaps because 45% also admit that impulse spending has derailed their financial progress in the past. Additionally, 49% plan to commit to “mindful spending” in 2026 as a key strategy to combat the rising cost of living and spend less overall.

But this isn’t a return to restrictive budgeting. Instead, 43% of people said they plan to adopt a ‘balanced’ expense management mindset for 2026. Rather than sticking to a rigid, zero-tolerance budget, the majority of consumers are opting for consistent tracking that still leaves breathing room for exceptions and the inevitable “life happens” moments.

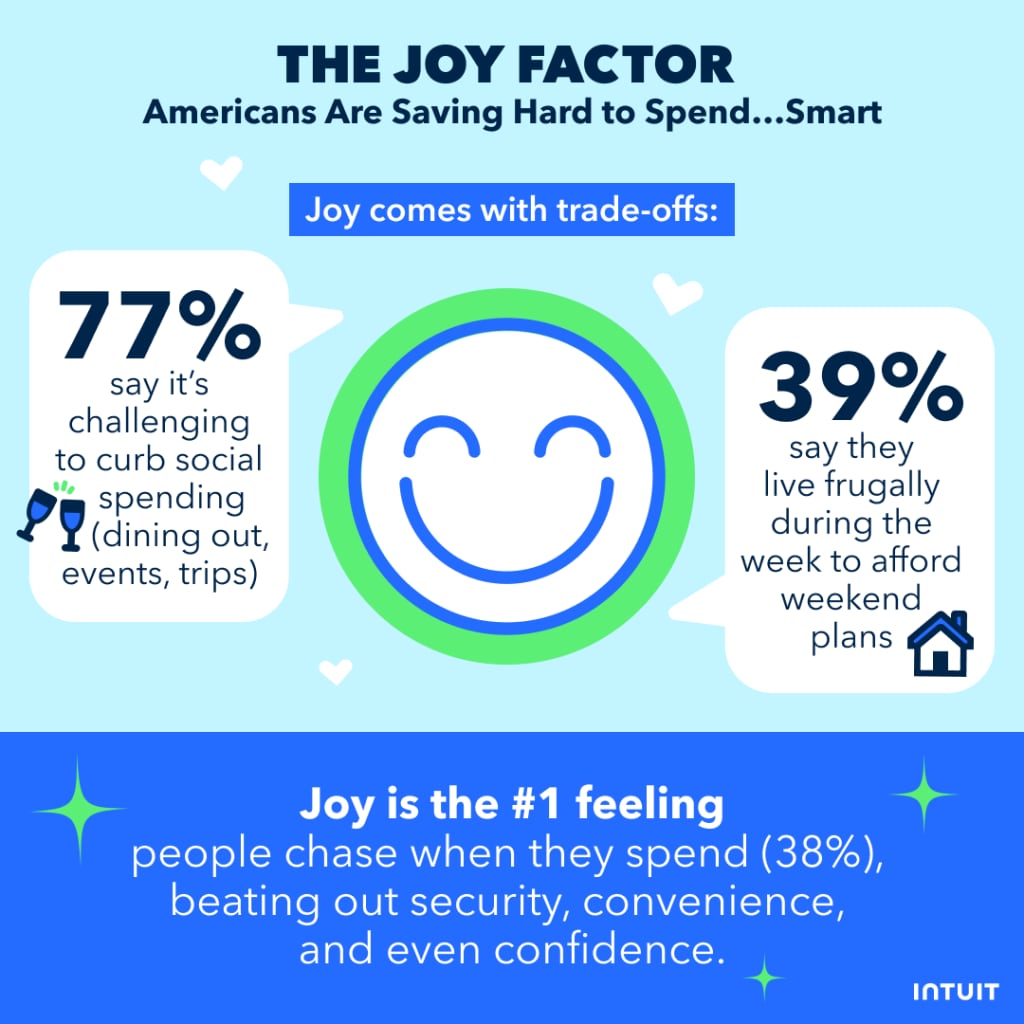

The Joy Factor: Strategic Saving for High-Impact Spending

Joy has emerged as the leading driver behind consumer spending (38%), outranking convenience, confidence, and even security. Further proving this pursuit is the fact that 41% say they feel justified in spending on things that make them happy, and 77% admit it’s challenging for them to curb social spending, such as dining out, events, and trips.

Even when money is tight, many refuse to abandon what they love. Dining out is the top non-negotiable indulgence for many (34%) — especially among women (34%), Millennials (38%), Black Americans (37%), and Latino Americans (40%). However, Men (36%) and Gen Z (38%) are most protective of their personal hobbies and activities.

In order to finance their joy, Americans are engaging in what we call “financial gymnastics.” 58% say that while they prioritize spending on their personal joy, they find creative ways to cover the costs, and 49% say they intentionally live frugally during the week in order to afford their weekend plans.

Ultimately, the 2026 outlook isn’t about being cavalier with cash; it’s a strategic shift toward value-based spending, ensuring that every dollar spent contributes meaningfully to consumers’ lives.

How Intuit Can be Your Financial Support System This Year

Another hard truth expressed by survey respondents is that 37% feel managing money is too overwhelming and they’re not sure where to even begin.

Intuit’s ecosystem — from Credit Karma to QuickBooks to TurboTax — is designed for this moment: predictive insights, automated tools, and smarter guidance help people go from feeling overwhelmed to feeling in control. This year’s Financial Wellness Month isn’t just about resolutions — it’s about rewriting the rules of money to create a life that’s both financially grounded and joyful.

Methodology

In December 2025, Intuit commissioned an online survey of 2000 U.S. consumers ages 18-28 (Gen Z), 29-44 (Millennials), and 45-60 (Gen X). The survey explored the current state of consumers’ financial health, including saving and spending habits, budgeting behaviors, stressors, and overall perceptions of financial wellness heading into the new year and Financial Wellness Month. The goal was to uncover how consumers are approaching money management today and where they feel most confident — or challenged. Percentages have been rounded to the nearest decimal place, so values shown in data report charts and graphics may not add up to 100%. Responses were collected using Pollfish audience pools and partner networks with double opt-ins and random device engagement sampling to ensure accurate targeting and results. Respondents received remuneration.