This fall, is the air filled with love, or is it inflation?

When it comes to love and money, many of us wish for two things: to build a solid income for ourselves, and to find a partner who also values financial security and success. But here’s the truth: generating money isn’t the same as successfully managing money. And in today’s economic climate, strong money management matters more than ever.

I often reflect on how finances shaped my own relationships and influenced who I considered to be a fiscally responsible lifelong partner. Now, I can’t help but wonder: what does that look like for the younger generation—especially as we see trends like recession indicators, “No Spend September,” the “soft-girl life,” and the growing resistance to splitting things 50/50 dominate conversations. To split or not to split the bill? This timeless dilemma is fueling debates across social media, as Gen Z weighs in on love and money.

To dig deeper, Intuit commissioned The Cuffing Economy Report—a nationwide study exploring how Gen Z, Millennials, and Gen X are navigating the intersection of money and relationships. The findings are clear: money isn’t just shaping wallets; it’s shaping the way people connect. From first dates to long-term commitments, financial pressures are rewriting the rules of modern romance and transforming #cuffingseason.

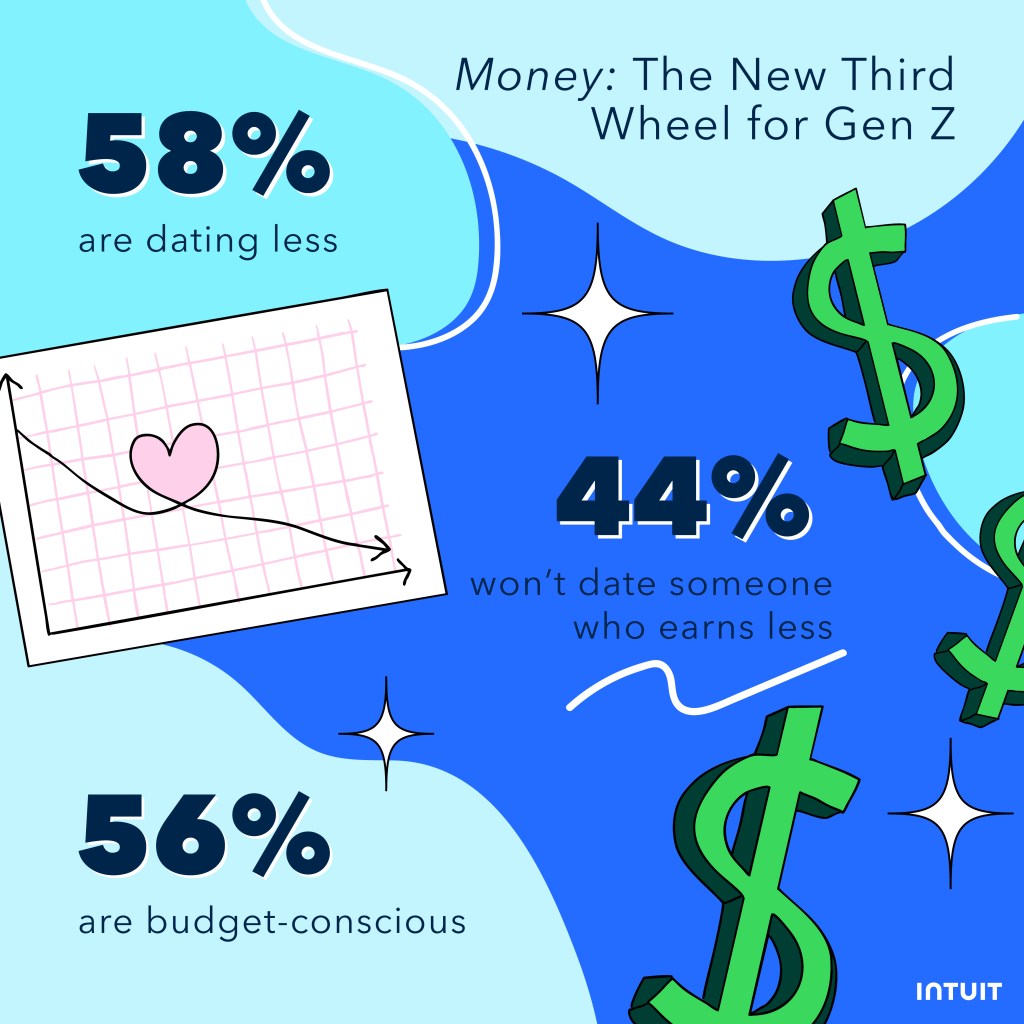

Money: The New Third Wheel

Dating has always been complicated and nuanced—but add rising costs and financial insecurity, and suddenly, money becomes the invisible third wheel. Here’s what our research uncovered:

- 51% of Americans are going on fewer dates due to today’s economy—Gen Z is hit hardest, at 58%.

- 54% have adjusted their dating habits to be more cost-effective, with men (60%) and Gen Z (56%) leading this shift.

- 44% of Gen Z say they’d only date someone who earns more than them, compared to just 29% of all adults.

- 33% of Americans have ended a relationship over money, with Millennials (38%) the most likely to call it quits.

Love may be blind, but it isn’t money-blind. Before people can truly invest in a stable partnership and all the responsibilities it brings, their financial well-being must come first. Until the “bag” is in check, relationships risk being unstable. Money, whether openly discussed or not, is always the third wheel—because it’s the foundation of a secure and lasting future together.

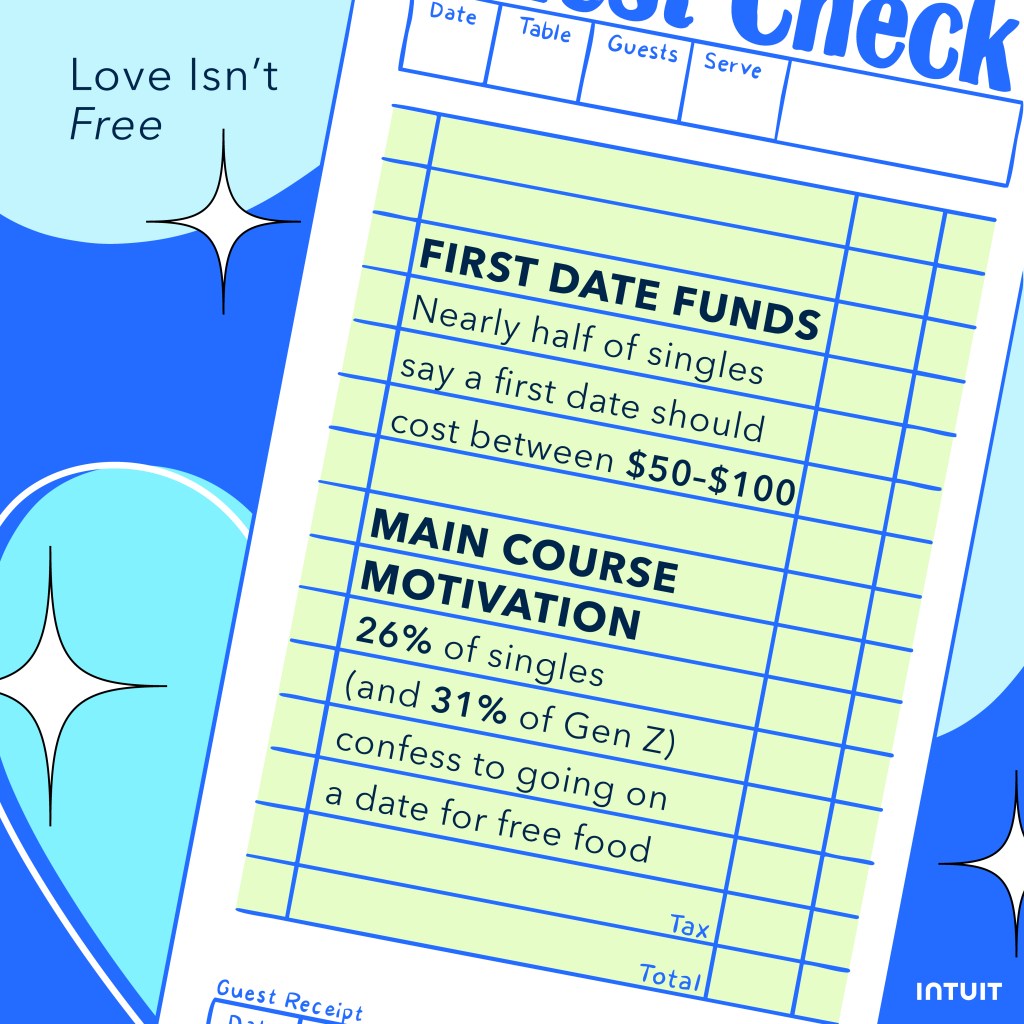

First Dates & Financial Boundaries

Even the age-old question of “who pays on the first date?” looks different in today’s economy. Rising costs have redefined what’s considered reasonable, and our research uncovered some surprising trends:

- 47% of Americans believe the sweet spot for a first date is between $50–$100—a rare moment of consensus across Gen Z, Millennials, and Gen X. In other words, people across generations are recalibrating expectations around affordability, signaling that splurging big isn’t necessarily seen as a sign of effort or interest anymore.

- 26% admit they’ve gone on a date primarily for the free meal—with Gen Z leading at 31%. While it may sound comical, this statistic underscores the real financial pressures young adults are facing. For some, dating doubles as a way to stretch their budgets as much as it is about connection.

Funny as it sounds, these stats highlight a real shift. Dollars and cents are influencing everything from where couples go to how seriously they take the date. Love may still be the main course, but the check is definitely setting the tone. In a climate where every dollar counts, financial realities are quietly steering the direction of romance, and ultimately the outcomes of modern love in the 21st century.

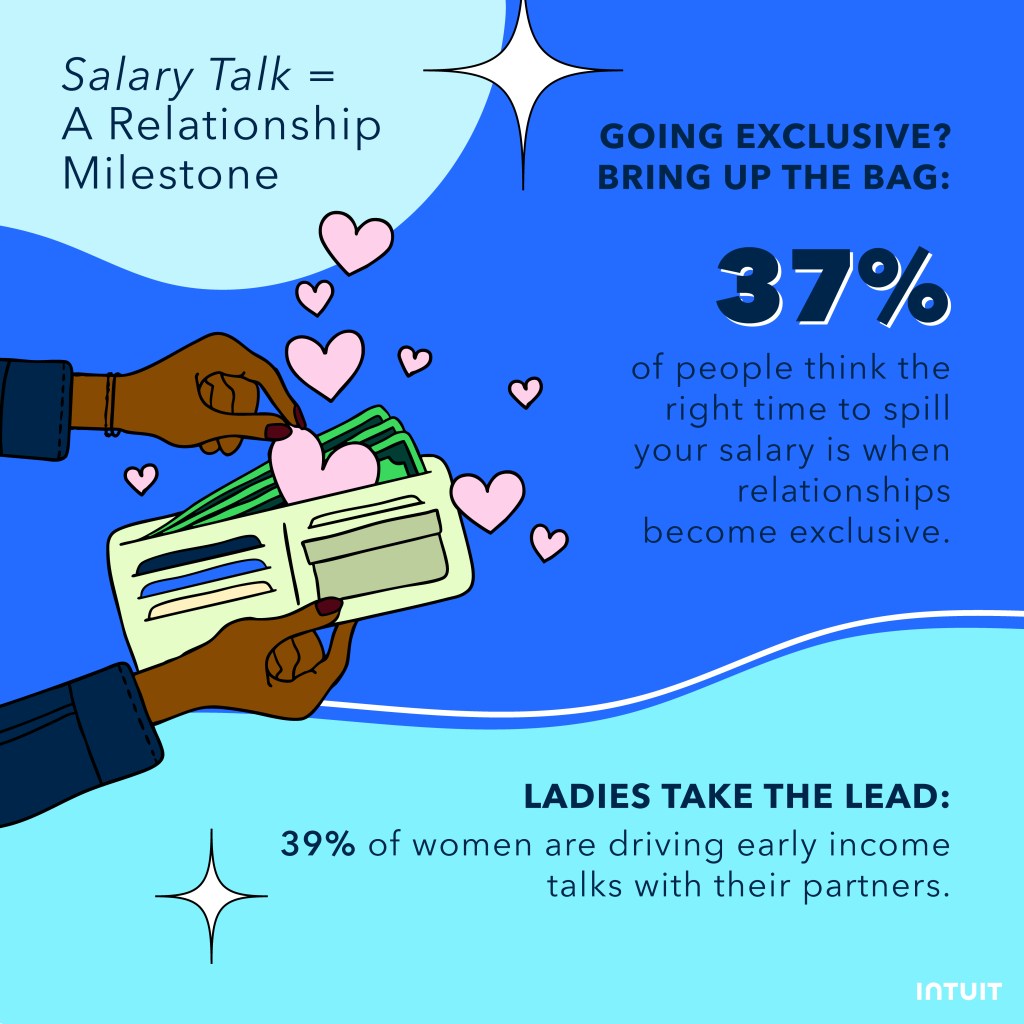

Milestones & Money Talks

In today’s dating landscape, financial transparency is becoming a relationship milestone in its own right. Forget waiting until marriage to merge finances—modern couples are talking cash and opening up about money much earlier:

- 37% say the right time to share your salary is when you become exclusive—not when you move in or get engaged. Translation: the “What are we?” conversation now comes with a side of “So, what’s your paycheck looking like?”

- When it comes to merging money, most couples are holding back. 54% keep finances separate, skipping joint accounts in favor of individual control.

This trend signals a cultural reset. Independence isn’t just practical in an unpredictable economy—it has become a core value underpinning modern love. Couples are essentially saying: “I want to build a life with you, but I also want to keep my finances separate while we do it.”

Looking ahead, this shift could redefine the financial “rules” of relationships. For future generations, financial independence may not be a safeguard but the default foundation of commitment. Gone are the days when one partner managed all the money; in their place is a model of shared financial responsibility—proof that love and autonomy can thrive side by side.

How Intuit Empowers Financial Success in Love

At Intuit, we believe financial success and well-being creates space for meaningful connections. With tools like TurboTax to maximize refunds, Credit Karma to keep credit healthy, and QuickBooks to track business spending, we’re helping individuals and couples successfully navigate love and money with confidence.

Whether you’re deciding when to discuss debt, how to split expenses, or whether it’s time to merge accounts, Intuit empowers you to make financial decisions that support—not strain—your relationships.

Because when money stress fades, love has the space to not only survive but thrive.

Methodology

In September 2025, Intuit commissioned an online survey of 1,500 U.S. consumers ages 18-28 (Gen Z), 29-44 (Millennials), and 45-60 (Gen X). The survey focused on uncovering consumer trends and insights among these demographics, with a particular emphasis on the real financial experiences of today’s consumers to uncover the intersection of romance and money—revealing what really matters when it comes to modern dating. Percentages have been rounded to the nearest decimal place, so values shown in data report charts and graphics may not add up to 100%. Responses were collected using Pollfish audience pools and partner networks with double opt-ins and random device engagement sampling to ensure accurate targeting and results. Respondents received remuneration.