Bookkeeping is a great place to start if you’re hoping for a way to break into the finance industry. There are many bookkeeping job opportunities and generally fewer education requirements than in other finance and accounting positions.

Bookkeepers are an essential part of any business. They ensure that business financial records are up-to-date and accurate, and this helps companies make financial decisions and focus on growing their business and focus on growing their business. Therefore, there are often opportunities opening up for in-house bookkeepers, remote bookkeepers, or freelance bookkeepers.

Read more below to learn about bookkeeping, typical responsibilities, how to become a bookkeeper, and remote bookkeeping opportunities with Intuit working on QuickBooks Live in the U.S. 50 states. Then, kickstart your bookkeeping career by signing up for an Intuit Bookkeeping Certification.

What is bookkeeping?

Bookkeeping is a part of the accounting process that involves recording financial transactions. This could include how a business tracks client invoices, bills, receipts, or other purchases. Bookkeeping may also include the creation of financial statements and processing payroll.

A business’ bookkeeping process may vary based on its accounting methods, the type of business, the use of technology, the size of its business, and more. Regular bookkeeping makes it easier for businesses to:

- Access detailed financial information quickly and easily

- Make educated financial decisions based on the business’s current financial situation

- Prepare for tax season and possible audits

A business must have bookkeeping processes and policies that keep company records up-to-date and accurate. For example, business owners must be diligent about keeping personal and business finances separate. In addition, smaller businesses may use single-entry bookkeeping, while larger businesses are more likely to use double-entry bookkeeping. As a bookkeeper, you may need to help the business learn the best practices to keep their financial records up to date and organized.

What does a bookkeeper do?

Bookkeepers are responsible for recording financial transactions related to the business. While most bookkeepers work with businesses, some individuals may also choose to hire a bookkeeper to track personal finances.

A client’s financial activities will include all transactions related to their income and expenses and a bookkeeper is responsible for recording all of these transactions accurately. Some bookkeepers may also have to facilitate financial transactions and ensure transactions are legally compliant.

Below are example tasks a bookkeeper may complete:

- Budgeting and cash flow reporting

- Processing payroll

- Tracking and recording inventory

- Recording bills and paying invoices; ensuring Accounts Payable is up to date so the company knows what they owe.

- Sending invoices to clients for services or purchases so the company knows what is due to them.

- Reconciling all Balance Sheet Accounts

- Recording all transactions

to ensure accurate financial statements

- Checking and updating the general ledger

- Using online banking

- May work with 3rd party apps for tracking revenue and payments

- Following accounting principles, policies, and procedures

- Preparing accurate financial reports for owners/shareholders

Bookkeepers regularly work with numbers and data. Many of the processes, policies, and procedures include detail-oriented tasks to ensure financial accuracy.

How to Become a Bookkeeper

Bookkeepers are not required to have certifications or specific education unless required by a specific employer. However, completing a bookkeeping certification program can teach you basic accounting and how to perform bookkeeping tasks and has the potential to set you apart from other bookkeepers.

You may be able to get on-the-job training through a bookkeeping job that only requires a high school diploma, such as an internship or training placement. You may also pursue certification programs or use online courses to become a self-taught bookkeeper.

Self-taught bookkeepers use a variety of courses, seminars, books, and other online resources to learn about bookkeeping and accounting. You can also learn how to use accounting software, like QuickBooks, which can teach you about the basics of bookkeeping as well as the technology used by many businesses.

On the other hand, many employers require additional education, such as a college degree. You may consider earning an associate or bachelor degree in accounting or business administration. While this takes longer and costs more money, it may potentially open the door for jobs at a higher level.

Whichever route you choose, some skills you should learn include:

- Double-entry bookkeeping

- How to manage payroll

- Accounts payable and accounts receivable

- Accounting and finance skills

- Technology and accounting software

- Data entry and analytics

- Job skills, such as leadership, negotiation, and presentations

When you feel you have enough education, you can begin applying for jobs or start your own bookkeeping business. You will need to learn how to start a bookkeeping business in your location, such as how to file for a license if you choose to have an in-person office. Then, you can begin to look for clients.

How do you get a bookkeeping certificate?

Many organizations offer bookkeeping certification programs. Someformal certifications include the National Association of Certified Public Bookkeepers (NACPB) and the American Institute of Professional Bookkeepers (AIPB).

To become a Certified Public Bookkeeper (CPB) from the NACPB, you must complete the Accounting Fundamentals course and pass the Uniform Bookkeeping Certification exam.

The Certified Bookkeeper (CB) program from the AIPB requires you to be a working bookkeeper or have at least one year of accounting education. The program includes self-teaching workbooks that prepare you to pass the CB exam.

Other courses and programs include:

- Coursera

- AccountingCoach, LLC

- U.S. Career Institute

- Udemy

- LinkedIn Learning

- Penn Foster College Inc.

Many programs will provide certificates to show you completed the course. Some provide free and low-cost resources, while others may be more expensive but provide more knowledge.

Intuit Academy Bookkeeping

Intuit Academy offers courses that teach the basics of bookkeeping, and successful test-takers may use their badge and certificates for education and career advancement.

There are four courses included in the Bookkeeping Professional Certificate program:

- Bookkeeping Basics — Define accounting, understand bookkeeping tasks, gain foundational knowledge of double-entry bookkeeping, and learn about ethical and social responsibility.

- Assets in Accounting — Learn common types of assets, account for inventory, understand how to record depreciation, and record transactions in relation to the accounting equation.

- Liabilities and Equity in Accounting — Understand the characteristics of liabilities, payroll accounting and tasks. Learn about types of equity, and describe a business’s financial position based on the accounting equation.

- Financial Statement Analysis — Use bank reconciliation to control cash flow, make financial decisions based on statements, describe financial statement analysis, and learn how to assess financial health.

Your Intuit Certified Bookkeeping Professional badge can be used to show any employer or client that you have an understanding of bookkeeping and accounting. It also opens up the possibility of becoming a remote QuickBooks Live bookkeeper with Intuit.

What jobs can you get with a bookkeeping certificate?

A bookkeeping certificate can help you find a bookkeeping role, either as an in-house bookkeeper or as a freelancer. Bookkeeping lays the groundwork for many accounting processes, so you can use your experience and knowledge as a stepping stone to becoming an accountant. However, you will likely need to complete a degree program and other certifications to be an accountant or move beyond a bookkeeping role.

How to Become a Virtual Bookkeeper

As more people move to working from home, freelancing, or starting their own businesses, you may want to learn how to become a virtual bookkeeper. A virtual bookkeeper must meet the same educational requirements as an in-house or in-person bookkeeper. Therefore, you should consider the education opportunities discussed above.

There are many opportunities to work in a salaried position from home to gain on-the-job training. The Intuit Tax and Bookkeeping Talent Community is a great place to find remote bookkeeping jobs and access training material. You can also find remote jobs on job board websites such as Indeed.

If you’re interested in being a freelance virtual bookkeeper, you can sign up for freelance marketplace websites to connect with potential clients. Freelance jobs can range from quick temporary projects to long-term employment. However, they may be less likely to offer training or educational opportunities.

Bookkeeping Career at Intuit

QuickBooks Live connects bookkeepers with small businesses that need help doing their books. Some tasks QuickBooks Live bookkeepers perform include providing assistance in setting up charts of accounts, categorizing transactions, reconciling accounts, preparing financial reports, and more.

Intuit’s bookkeeping service is not full-service bookkeeping. For example, the client is responsible for entering transactions. Intuit partners with clients to provide support and assistance and works with them to ensure transactions are categorized and reconciled correctly so they have accurate financial reports each month. Customers schedule an appointment to have a bookkeeper review their transactions, and multiple schedules are available to choose from. You will have access to a client management portal, and can communicate with customers through video conferencing and messaging.

What’s it like to work as a Front Office Expert or Back Office Expert for QuickBooks Live? Watch the videos to find out what a day in the life is like for our Intuit bookkeeping experts.

Most remote QuickBooks Live bookkeepers work from home which means you need a reliable hard-wired internet connection and a landline phone. Intuit will provide a laptop with all the technology and software required to meet your responsibilities. Intuit will also provide a webcam, headset, USB hub, Ethernet cable, backdrop, and VPN token.

You must meet the following qualifications to become a QuickBooks Live bookkeeper:

- 3+ years of bookkeeping and/or accounting experience

- 3+ years of QuickBooks Online experience

- Credentials/Certifications: QuickBooks Online Certification Required (QuickBooks Online ProAdvisor)

- Experience supporting Payroll, Sales Tax, or Tax Preparation

- Strong customer service skills – ability to interact with customers through video and audio tools in a way that is professional, friendly and reassuring

QuickBooks Live bookkeepers work between 20 to 40 hours per week. The role can function as a part-time job to supplement other income, or you can be a full-time bookkeeper. If you become a QuickBooks Live bookkeeper, you can work from home based upon an agreed schedule at a set hourly rate based on your location, interview, and experience level. Join the Intuit Talent Community to see current job openings.

Career Benefits

Working as a QuickBooks Live bookkeeper for Intuit comes with many benefits, including:

- Medical, dental, and vision coverage

- A 401K savings plan with no vesting period

- Eligibility to participate in the Employee Stock Purchase Plan

- Basic life and accident insurance covered by Intuit

- Wellness benefits, including ten free counseling sessions

- Target annual bonus of 8.5% of your base wages

- Discounts on electronics, dining, travel, and more

The virtual network of other bookkeepers is also a great resource. You can work with other bookkeepers and tax experts to share and expand your knowledge.

Career Path

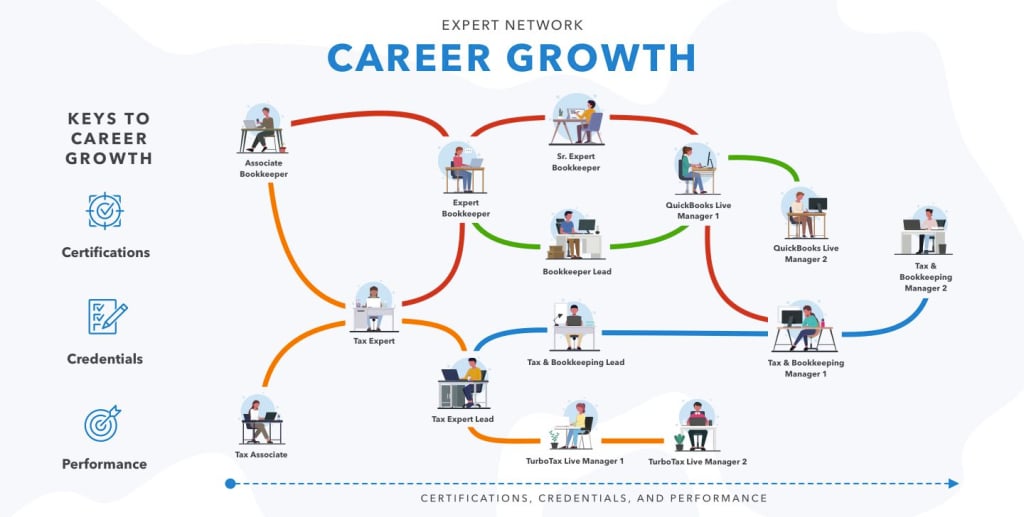

Intuit has many opportunities for bookkeepers to continue their career growth trajectory. An entry-level bookkeeper may begin as an Associate or Sr. Associate Bookkeeper and have the opportunity to move up to an Expert or Sr. Expert Bookkeeper position.

Some bookkeepers can also move into management positions, such as a Bookkeeper Lead, QuickBooks Live Manager 1, or QuickBooks Live Manager 2.

Intuit is dedicated to providing its employees with the ability to learn and grow throughout their time with our company. Once candidates are hired as employees, they will be provided with training assignments and other resources that prepare them for their positions. Intuit provides its employees with supplemental learning materials after training has been completed to assist employees in developing their skills.

In addition to moving up into higher-level positions, remote QuickBooks Live bookkeepers may also be able to enter into the tax domain by completing Intuit training and certification for taxes.

If you’re interested in becoming a QuickBooks Live bookkeeper, Intuit can provide you with the tools necessary to learn bookkeeping and accounting skills and get certified. Get started by signing up for the Intuit Bookkeeping Certification program today.

How to Become a Bookkeeper: Next Steps

Now that you understand how to become a bookkeeper, you are ready to get started on your new path. Whether you are already in the bookkeeping field or just starting out, this guide can help you determine your next steps.

If you’re interested in working remotely as a bookkeeper, applying directly or joining the Intuit Tax and Bookkeeping Talent Community may be the right move. Currently, there are three types of positions available for QuickBooks Live bookkeepers:

QuickBooks Live Bookkeeping Expert (Remote/Year Round)

- 3+ years of bookkeeping and/or accounting experience

- 3+ years of QuickBooks Online experience

- Credentials/Certifications: QuickBooks Online Certification Required (QuickBooks Online ProAdvisor)

- Experience supporting Payroll, Sales Tax, or Tax Preparation

- Strong customer service skills – ability to interact with customers through video and audio tools in a way that is professional, friendly and reassuring

QuickBooks Live Sr. Associate (Remote/Year Round)

- 1-3 years of bookkeeping and/or accounting experience

- Minimum 1 year of QuickBooks Online experience

- Credentials/Certifications: QuickBooks Online Certification Required (QuickBooks Online ProAdvisor)

- Strong customer service skills – ability to interact with customers through video and audio tools in a way that is professional, friendly and reassuring