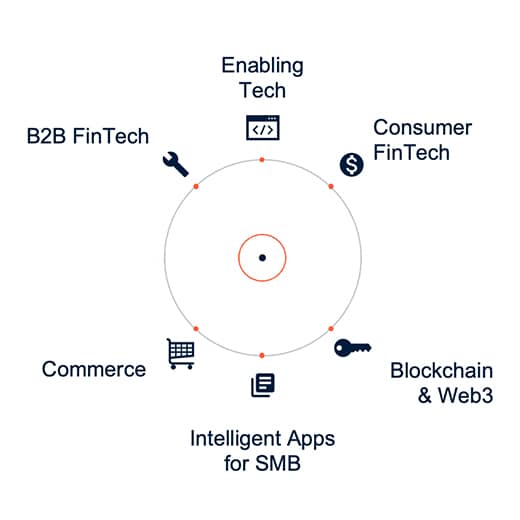

How we invest

We aim to balance financial return and strategic value to our portfolio companies and Intuit.

Announcing our investment in Wildfire

Lessons from a Year of Fintech

Announcing our Investment in Finch

Becoming an entrepreneur: what diverse founders need to know

How Intuit Ventures is scaling to support startups

1 of 1