We're hiring tax experts: Join our virtual recruitment event to learn more about our remote job opportunities. Register here.

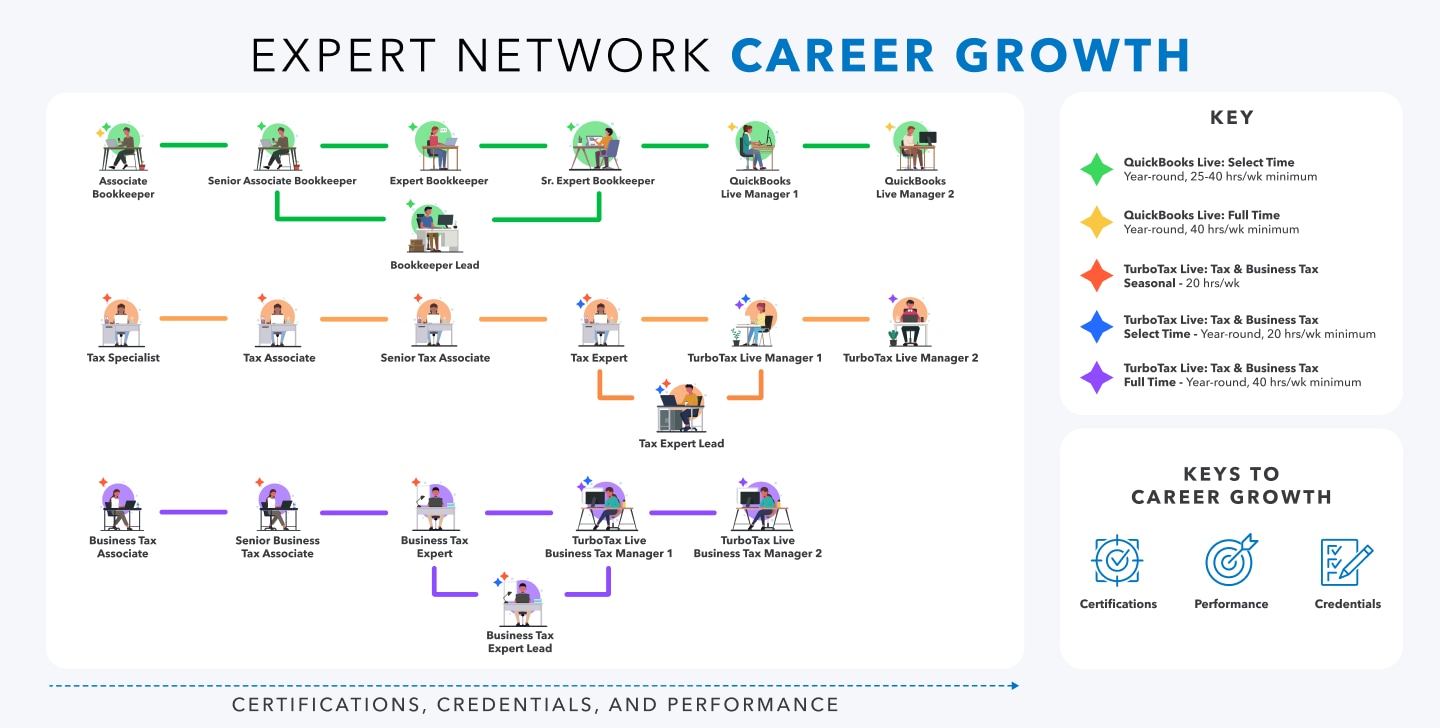

Move forward on your professional journey

Intuit is proud to be an equal opportunity employer. We make employment decisions without regards to race, color, religion, sex, sexual orientation, gender identity, national origin, age, veteran status, disability status, pregnancy, or any other basis protected by federal, state or local law. We also consider qualified applicants regardless of criminal histories, consistent with legal requirements. If you need assistance and/or a reasonable accommodation due to a disability during the application or recruiting process, please talk with your recruiter or send a request to TalentAcquisition@intuit.com.

For more information, please read our EEO policy. Intuit encourages people with criminal record histories to apply for employment, and values diverse experiences, including prior contact with the criminal legal system. To that end, Intuit welcomes such applicants in accordance with the California Fair Chance Act, Los Angeles City Fair Chance Act Ordinance, Los Angeles County Fair Chance Act Ordinance, the San Francisco Fair Chance Act Ordinance, and other similar laws. Philadelphia applicants can review information pertaining to Philadelphia’s Fair Criminal Record Screening Standards Ordinance here. Applicants for jobs in unincorporated areas of Los Angeles County can review a copy of the Los Angeles County Fair Chance Act Notice here.